FKLI - Near Flat Despite Good Intraday Swing

rhboskres

Publish date: Wed, 29 Apr 2020, 05:04 PM

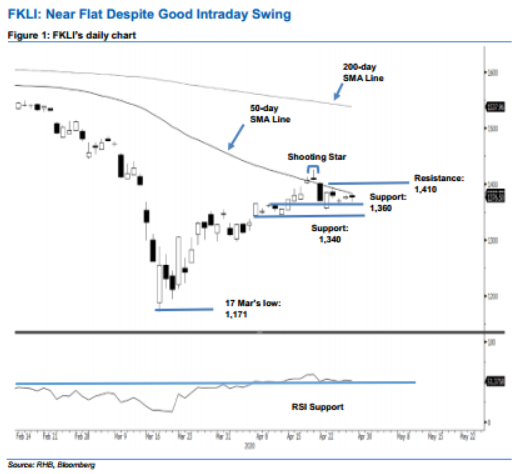

Still capped by 50-day SMA line; maintain short positions. The FKLI ended the latest session marginally lower by 0.5 pts at 1,376.5 pts. This was despite experiencing a relatively wide trading range of 1,367.5-1,383 pts. The index’s price performance over recent sessions is indicative of a minor pause taking place below the 50-day SMA line. This was after the index experienced a decline following the 20 Apr’s “Shooting Star” formation, which saw it fall from a high of 1,425.5 pts to a low of 1,352.5 pts on 22 Apr. Once this minor pause is completed, chances are high for the index to retest the 1,340-pt support level. Maintain our negative trading bias.

As we are not seeing the retracement phase showing any signs of completion, we recommended that traders stay in short positions, initiated at 1,370 pts – the closing level of 21 Apr. To manage risks, a stop-loss can be placed above 1,410 pts.

The immediate support is still pegged at 1,360 pts, followed by 1,340 pts. Towards the upside, the immediate resistance is eyed at 1,395 pts – the price point of 21 Apr. This is followed by 1,410 pts, near the 50-day SMA line.

Source: RHB Securities Research - 29 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024