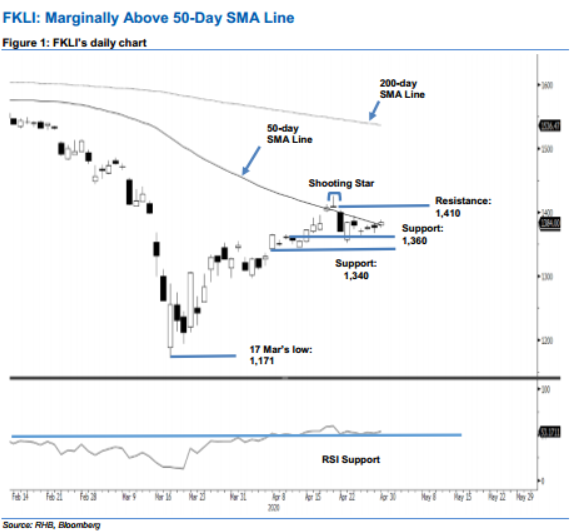

FKLI - Marginally Above 50-Day SMA Line

rhboskres

Publish date: Thu, 30 Apr 2020, 04:53 PM

Correction still has legs to go further; maintain short positions. The FKLI ended the latest trade 7.5 pts higher at 1,384 pts. Despite closing slightly above the 50-day SMA line, we still believe it was merely part of the index’s minor consolidation phase around the said SMA line, which has been developing in recent sessions. This consolidation phase set in after the index fell from the high of 1,425.5 pts registered on 20 Apr to a low of 1,352.5 pts on 22 Apr. All in, with the bias of the counter-trend rebound, which took place from the low of 1,171 pts on 17 Mar and completed with 20 Apr’s high, chances are high for the index to develop a correction phase to test the 1,300-1,340-pt level. Maintain our negative trading bias.

We recommended that traders stay in short positions, initiated at 1,370 pts – the closing level of 21 Apr. To manage risks, a stop-loss can be placed above 1,410 pts.

The immediate support is eyed at 1,360 pts, followed by 1,340 pts. Conversely, the immediate resistance is expected at 1,395 pts – the price point of 21 Apr. This is followed by 1,410 pts, near the 50-day SMA line.

Source: RHB Securities Research - 30 Apr 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024