FCPO - Still Capped By Immediate Resistance

rhboskres

Publish date: Mon, 04 May 2020, 09:16 AM

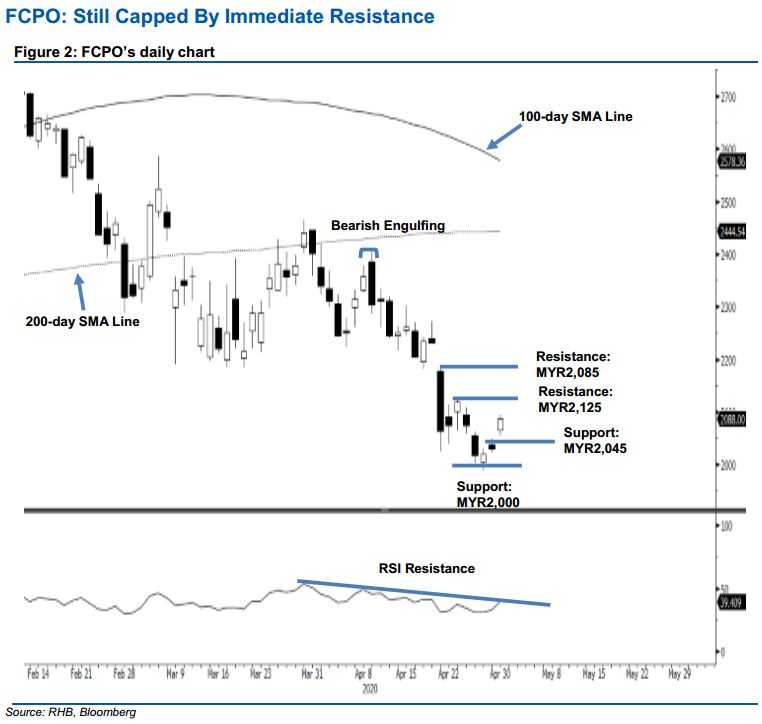

Still capped by the previous high; maintain short positions. The FCPO continued to extend its minor rebound into the third session – adding MYR57 to close at MYR2,088. The daily chart indicates that the commodity is still capped by the previous high of MYR2,125 – which implies that if there is still no price signal, a stronger rebound is taking place. It also means that the commodity’s downtrend is still firmly in place. This downtrend resumed in March after it fell below the 200-day SMA line. The bulls attempted to recaptured the said SMA line on 9 Apr – but were rejected again – and a “Bearish Engulfing” formation appeared. Additionally, the RSI is still capped by the downtrend line (as drawn in the chart). We maintain our negative trading bias.

We recommend that investors stick to short positions, We initiated these at MYR2,246, the close of 13 Apr. To manage risks, a stop-loss can now be placed above MYRY2,125.

The immediate support is revised to MYR2,045 – derived from 29 Apr’s candle, followed by MYR2,000. Moving up, the immediate resistance is set at MYR2,125, the high of 23 Apr. This is followed by MYR2,085 – the high of 21 Apr.

Source: RHB Securities Research - 4 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024