WTI Crude Futures - Rebound Hit Minimum Target

rhboskres

Publish date: Mon, 04 May 2020, 09:35 AM

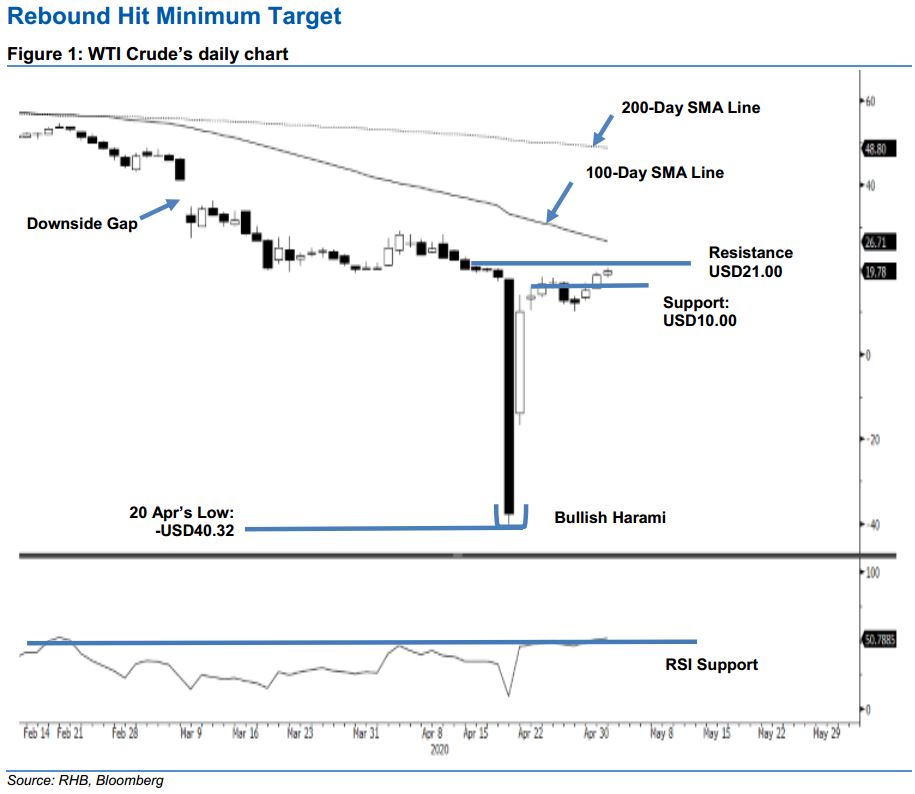

Maintain long positions as the rebound is showing signs of extending. The WTI Crude settled the latest session higher by USD0.94 at USD19.78 – crossing above the minimum rebound target that we initially set, ie USD18.26. This positive performance is signalling that the counter-trend rebound which set in subsequent from 21 Apr’s “Bullish Harami” is gaining an even stronger traction – after relatively volatile trading recently. This rebound set in to correct the commodity’s previous sharp multi-week correction which reached its extreme with the negative pricing on 20 Apr. The RSI reading has also improved and crossed above the 50 neutral level. Maintain our positive trading bias.

While the counter-trend rebound has reached our minimum rebound target, in the absence of a price reversal signal, we are keeping our long positions recommendation while moving the trailing-stop loss to breakeven. The positions were initiated at USD15.06 – the closing level of 29 Apr.

The immediate support is revised to USD18.00 – near the latest low. This is followed by USD16.00. Moving up, the immediate resistance is now pegged at USD21.00, near the high of 15 Apr, followed by USD23.00.

Source: RHB Securities Research - 4 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024