WTI Crude Futures - Testing the Immediate Resistance

rhboskres

Publish date: Tue, 05 May 2020, 09:22 AM

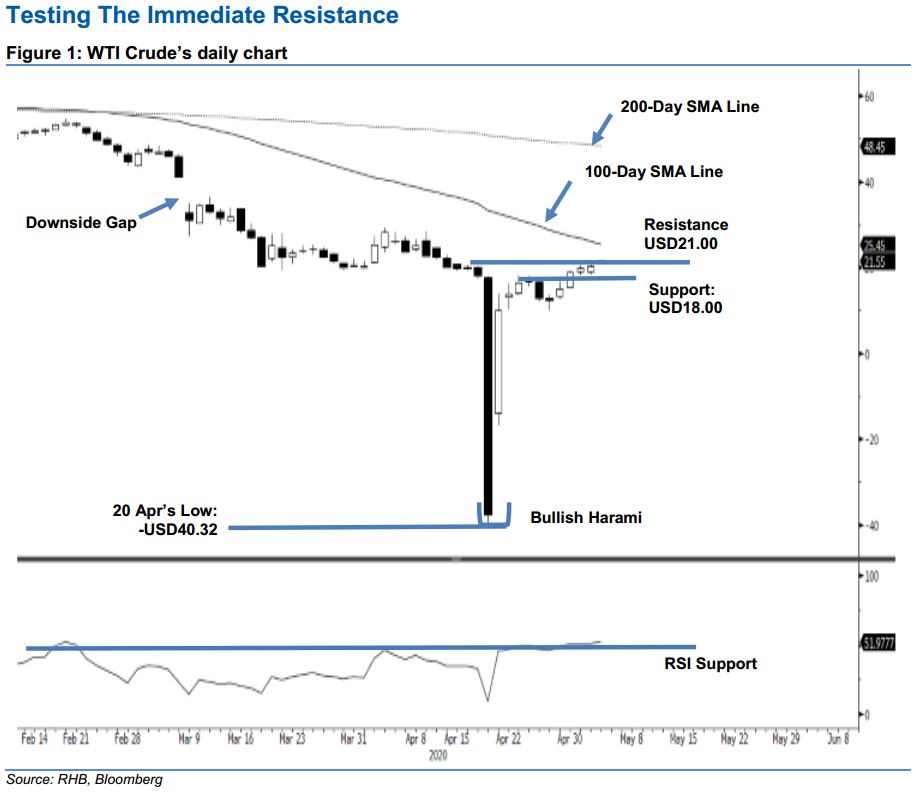

The bulls are still pushing the rebound; maintain long positions. The WTI Crude continued to extend its rebound after recently breaking above our previous minimum rebound target of USDD18.26. The commodity settled USD0.61 better at USDD20.39, after testing the USD21.00 immediate resistance with a high of USD21.42. This positive session was a subsequent rebound continuation to 21 Apr’s “Bullish Harami” formation. This rebound kicked in to correct the WTI Crude’s previous multi-week sharp retracement, which saw the RSI reach an oversold reading in April. In the absence of a price-reversal signal, we are keeping to our positive trading bias.

As the bulls are still in a good control over the rebound, ie showing no signs of exhaustion, we maintain our long positions recommendation while moving the trailing-stop loss to breakeven. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is maintained at USD18.00 – near the latest two sessions’ lows – and followed by the USD16.00 level. Towards the upside, the immediate resistance is now pegged at USD21.00, ie near the high of 15 Apr. This is followed by the USD23.00 level.

Source: RHB Securities Research - 5 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024