FCPO - Downtrend Extending

rhboskres

Publish date: Tue, 05 May 2020, 09:34 AM

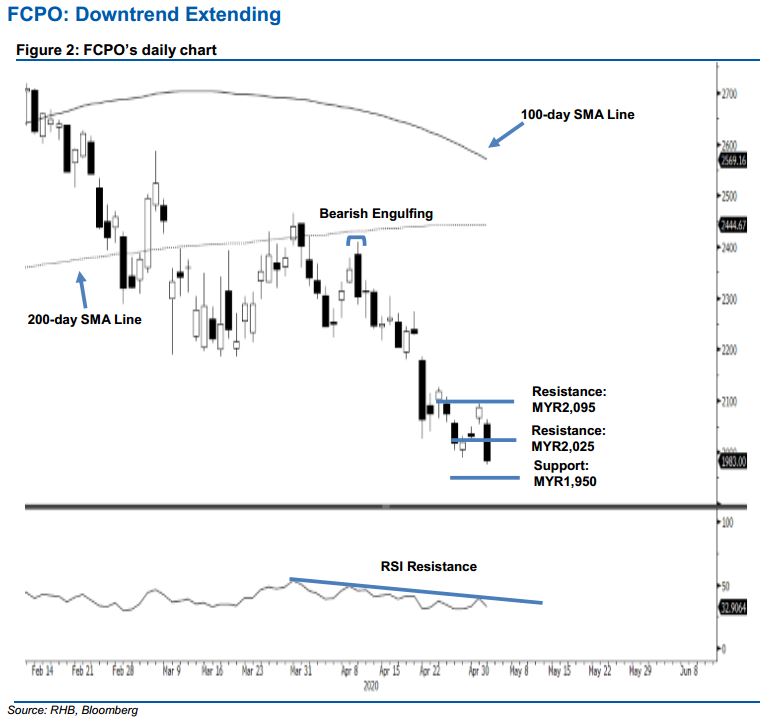

Maintain short positions to ride the trend. The FCPO ended its three consecutive minor rebounds with a sharp drop in the latest session, ending MYR105 lower at MYR1,983 and crossing below the previous support levels of MYR2,045 and MYR2,000. The weak session marked a lower low which means the downtrend is still firmly in place. This negative trend is further supported by the 100-day SMA line curving lower, while the 200-day SMA line, which previously trended upwards, has been showing sign of plateauing - indicating a bearish bias. For now, as long as the commodity is still capped by the MYR2,095 resistance, the trading bias would stay negative.

With no signs bulls coming back, we recommend that investors stick to short positions, We initiated these at MYR2,246, the close of 13 Apr. To manage risks, a stop-loss can now be placed above MYRY2,095.

The immediate support is revised to MYR1,950, this is followed by MYR1,918, the low of 10 Jul 2019. Moving up, the resistance points are pegged at MYR2,025 – price point of the latest session. This is followed by MYR2,095, the high of 30 Apr.

Source: RHB Securities Research - 5 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024