WTI Crude Futures - Resistance Levels Crushed

rhboskres

Publish date: Wed, 06 May 2020, 05:11 PM

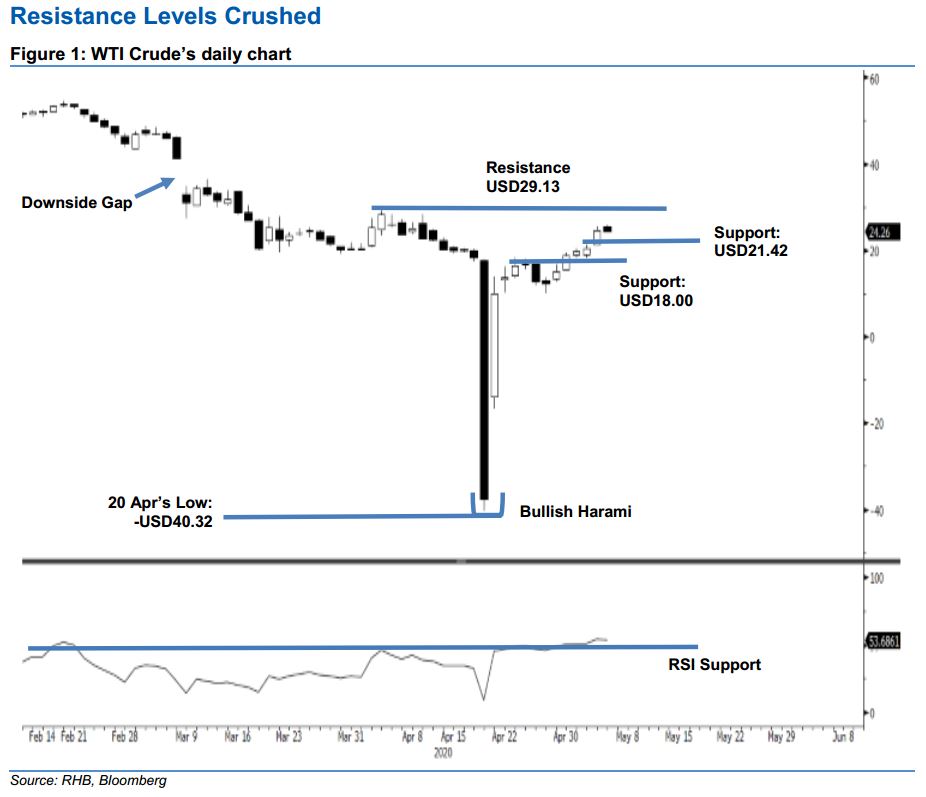

Maintain long positions, as the counter-trend rebound remains firm. The WTI Crude’s rebound is extending, as it added USD4.17 to close at USD24.56. This crossed above the previous USD21.00 and USD23.00 resistance points. While the rebound over the past week or so has been very sharp, we are not seeing any negative price actions that could indicate the rebound has reached its top. Also, the RSI reading is at 53.7 level. This rebound set in after the commodity experienced a historic washout on 20 Apr, where it reached a negative pricing on the back of an oversold RSI reading. We maintain our positive trading bias.

As the bulls are still signalling a firm control over the rebound, we maintain our long position recommendations while moving the trailing-stop loss to below USD18.00. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is revised to USD21.42 – the high of 4 May – and followed by USD18.00, which is near the lows of 1 and 4 May. Towards the upside, the immediate resistance is now pegged at USD27.00, and followed by USD29.13, or the high of 3 Apr.

Source: RHB Securities Research - 6 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024