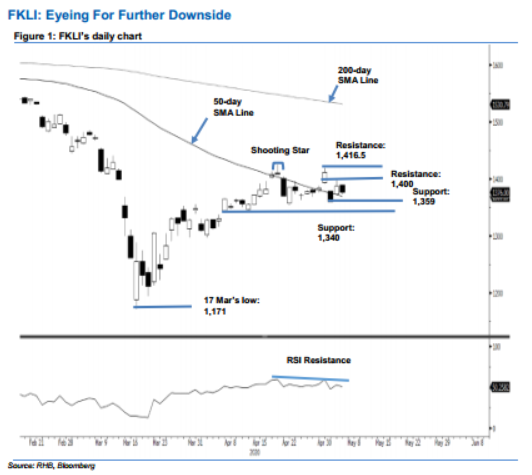

FKLI - Eyeing For Further Downside

rhboskres

Publish date: Fri, 08 May 2020, 05:42 PM

Maintain short positions as correction phase is complete. The FKLI reversed from its earlier session’s positive tone to settle 10.5 pts weaker at 1,376 pts – the high was posted at 1,390.5 pts. The performance can be seen as a negative follow-up subsequent from the prior session’s fill-up of 4 May’s “Downside Gap”. We maintain the view that the index’s correction phase which started from 20 Apr’s “Shooting Star” formation is still incomplete. A downside breach of the 50- day SMA line in the coming sessions could open the door for a further downside move with a retracement target towards the 1,300-1,350-pt area. Maintain our negative trading bias.

As the bears are still in control over the index’s direction, traders should remain in short positions, initiated at 1,370 pts – the closing level of 21 Apr. To manage risks, a stop-loss can be placed above 1,410 pts.

We are keeping the immediate support target at 1,359 pts, the low of 4 May, followed by 1,340 pts. Conversely, the immediate resistance is eyed at 1,400 pts. This is followed by 1,416.5 pts, the high of 4 May.

Source: RHB Securities Research - 8 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024