FCPO - Nearing The MYR2,025 Resist

rhboskres

Publish date: Tue, 12 May 2020, 10:01 AM

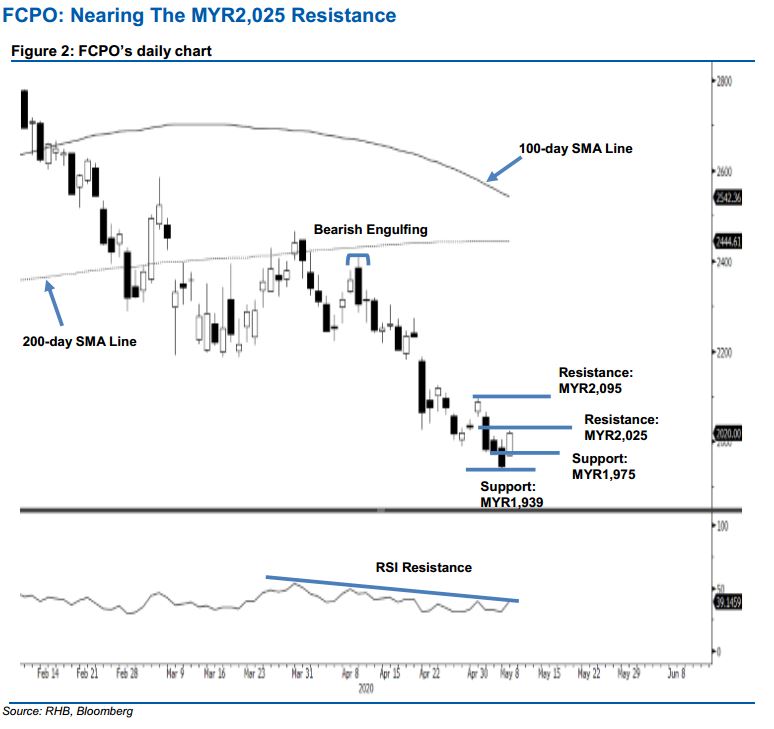

Maintain short positions until bulls signal a reversal. The FCPO formed a white candle to end the latest session MYR74 stronger, at MYR2,020 – crossing above the previous immediate resistance of MRY1,975. Towards the upside, should the MYR2,025 resistance mark be breached in the coming sessions, together with an upside breach of the RSI resistance line (as drawn in the chart), chances are high that the commodity will be ready to stage a stronger rebound phase. Until this happens, we are maintaining our negative trading bias.

Until the bulls indicate that there will be a change in the price trend, we recommend that investors stick to short positions. We initiated these at MYR2,246, the close of 13 Apr. To manage risks, a stop-loss can now be placed above MYR2,025.

The immediate support is revised to MYR1,975 – the price point of the latest session, this is followed by MYR1,939, the low of 6 May. Meanwhile, the immediate resistance is set at MYR2,025 – derived from 4 May’s candle. This is followed by MYR2,095 – the high of 30 Apr.

Source: RHB Securities Research - 12 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024