FKLI - Correction Phase Is Incomplete

rhboskres

Publish date: Tue, 12 May 2020, 10:01 AM

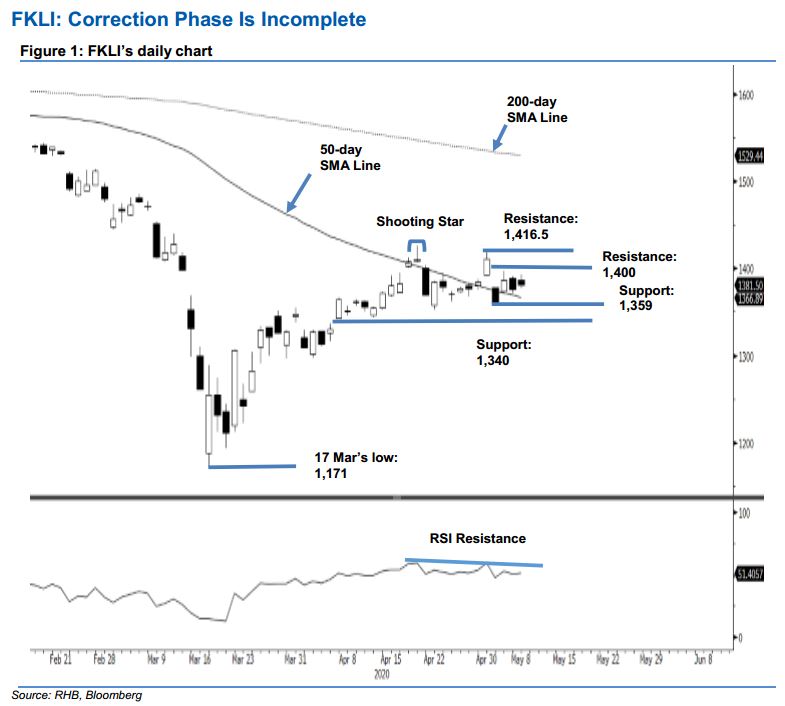

Correction phase likely to be extended; maintain short positions. The FKLI reached a high of 1,392.5 pts, before closing at 1,381.5 pts last Friday – indicating a gain of 5.5 pts. Despite showing signs of developing a minor rebound over the latest three sessions, the index is still capped by the 1,400-pt immediate resistance mark. In the broader technical picture, we believe the correction phase that set in following the 21 Apr’s “Shooting Star” formation is still incomplete. Towards the downside, should the 50-day SMA line be breached southwards, the index could retrace towards the 1,300-1,350 pt area. We maintain our negative trading bias.

Traders are advised to remain in short positions, initiated at 1,370 pts – the closing level of 21 Apr. To manage risks, a stop-loss can be placed above 1,410 pts.

The immediate support is maintained at 1,359 pts, the low of 4 May, followed by 1,340 pts. Moving up, the immediate resistance is pegged at 1,400 pts. This is followed by 1,416.5 pts, the high of 4 May.

Source: RHB Securities Research - 12 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024