Hang Seng Index Futures - Sentiment Remains Negative

rhboskres

Publish date: Tue, 12 May 2020, 10:18 AM

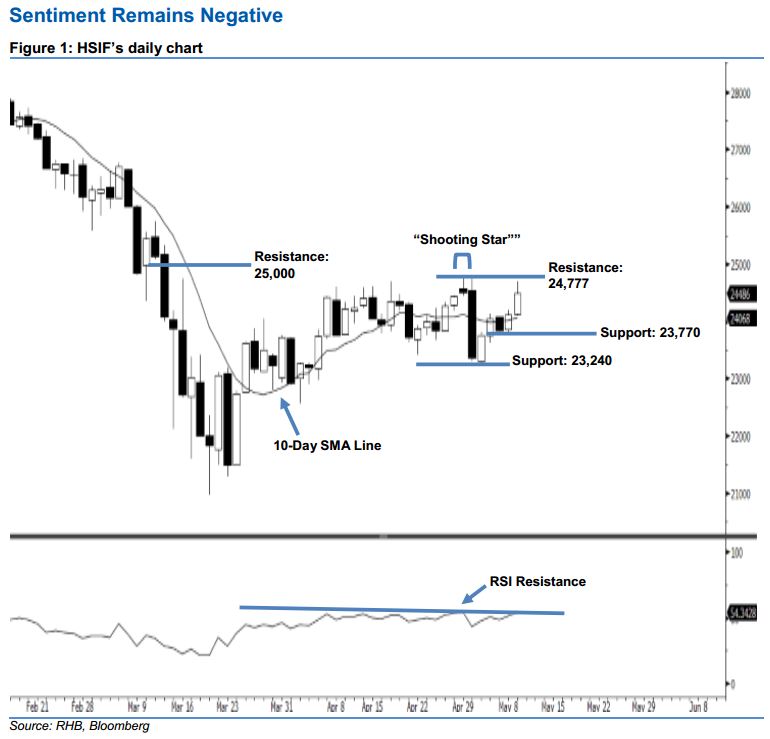

Stay short, with a trailing-stop set above the 24,777-pt resistance. The HSIF ended higher to form a white candle yesterday. It rose to a high of 24,700 pts during the intraday session, before ending at 24,486 pts for the day. However, we think the negative sentiment stays unchanged, as the index is still trading below the recent high of 24,777-pt resistance mentioned previously. Technically speaking, as long as the HSIF fails to negate the bullishness of 29 Apr’s “Shooting Star” pattern, we believe the sellers still have control of the market. Overall, we remain negative on the index’s outlook.

As seen in the chart, we are eyeing the immediate resistance level at 24,777 pts, obtained from the high of 29 Apr’s “Shooting Star” pattern. If a breakout occurs, the next resistance is anticipated at the 25,000-pt psychological mark. Towards the downside, the immediate support level is seen at 23,770 pts, ie near the lows of 7-8 May. The crucial support is situated at 23,240 pts, defined near the previous low of 5 May.

Thus, we advise traders to stay short, following our recommendation of initiating short below the 24,132-pt level on 8 May. In the meantime, a stop-loss can be set above the 24,777-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 12 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024