WTI Crude Futures - Rebound Still Alive

rhboskres

Publish date: Wed, 13 May 2020, 06:10 PM

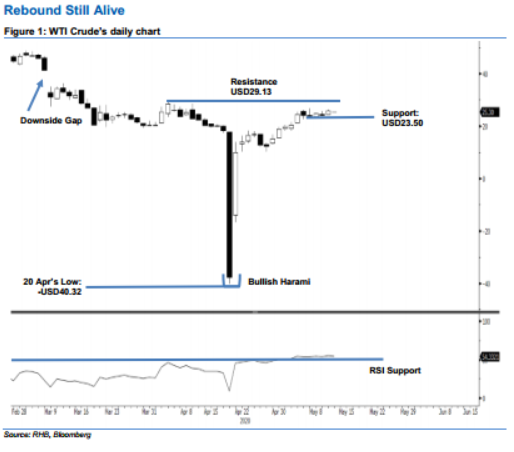

Maintain long positions. The WTI Crude formed a white candle, handing in a USD1.64 gain to settle at USD25.78 – after it traded in the range of USD24.22 to USD26.23. We see the positive closing as part of the commodity’s minor consolidation phase that has been in development over the recent sessions. This consolidation may still be extending in the coming sessions but likely in a relatively narrow fashion. It set in after the back gold experienced a relatively sharp rebound following 21 Apr’s “Bullish Harami” formation to reach an area near the USD27.00 resistance point on 6 May. Maintain our positive trading bias.

As a relatively minor consolidation is taking place, we maintain our long positions recommendation while moving the trailing-stop loss to below USD20.00. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is revised to USD23.50 – derived from 8 May’s candle. This is followed by USD22.00, or the price point of 5 May. Towards the upside, the immediate resistance is now pegged at the USD27.00 threshold. This is followed by USD29.13 – the high of 3 Apr.

Source: RHB Securities Research - 13 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024