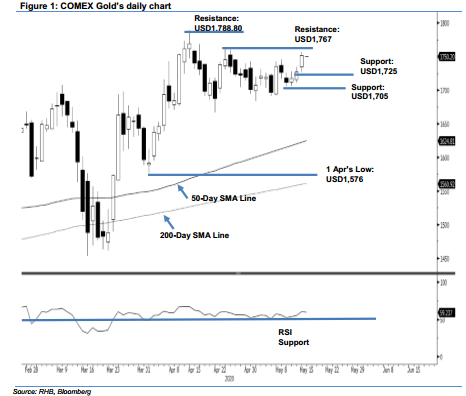

COMEX Gold: Testing Immediate Resistance

rhboskres

Publish date: Wed, 13 May 2020, 06:28 PM

Still trading within the correction phase; maintain short positions. The COMEX Gold ended the latest trade on a positive note – despite not being able to hold on to most of its intraday gains. At one point, it tested the immediate resistance of USD1,727 with a high of USD1,728.40, before closing at USD1,717.30. Broadly, the commodity is still seen as trading in a correction phase, following a sharp upward move between March and midApril, which saw the precious metal reach a multi-year high of USD1,788.80. At this juncture, as long as the commodity is still capped by the USD1,745 resistance point, the correction phase may still be able to extend. Maintain our negative trading bias.

As the correction is still not showing signs of reaching an end, we advise traders to stay in short positions. These were initiated at USD1,701, or the closing level of 30 Apr. For risk-management purposes, a stop-loss can be placed above the USD1,745 threshold.

The immediate support is eyed at the USD1,700.00 round figure. This is followed by USD1,666.20, or the low of 21 Apr. Moving up, the immediate resistance is now pegged at USD1,727.00 – near 11 May’s high – and followed by USD1,745.00, ie near the high of 30 Apr.

Source: RHB Securities Research - 13 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024