WTI Crude Futures - Bulls Are Pausing

rhboskres

Publish date: Thu, 14 May 2020, 06:33 PM

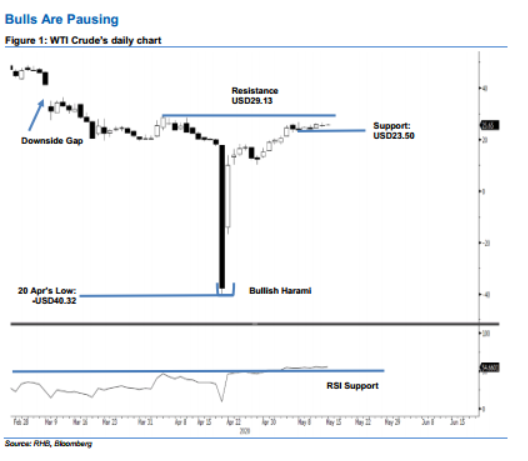

Maintain long positions as the minor consolidation phase is still developing. The WTI Crude failed to hold on to its intraday gains. After hitting a high of USD26.45, the commodity slid lower to close at USD25.29 – indicating a decline of USD0.49. As mentioned in our recent reports, the commodity has been experiencing a consolidation phase over the recent sessions. This was after it staged a strong rebound, following the historic washout session on 20 Apr – which saw prices plunge into negative territory. The ongoing multi-session consolidation phase is deemed healthy and does not show signs that the rebound is topping off yet. Maintain our positive trading bias.

On the observation that the consolidation phase is still relatively narrow, we maintain our long positions recommendation while moving the trailing-stop loss to below USD20.00. These positions were initiated at USD15.06, or the closing level of 29 Apr.

We are keeping the immediate support target at USD23.50 – derived from 8 May’s candle. This is followed by USD22.00, or the price point of 5 May. Moving up, the immediate resistance is now pegged at the USD27.00 threshold. This is followed by USD29.13 – the high of 3 Apr.

Source: RHB Securities Research - 14 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024