COMEX Gold - Still Hovering in Consolidation Zone

rhboskres

Publish date: Thu, 14 May 2020, 06:34 PM

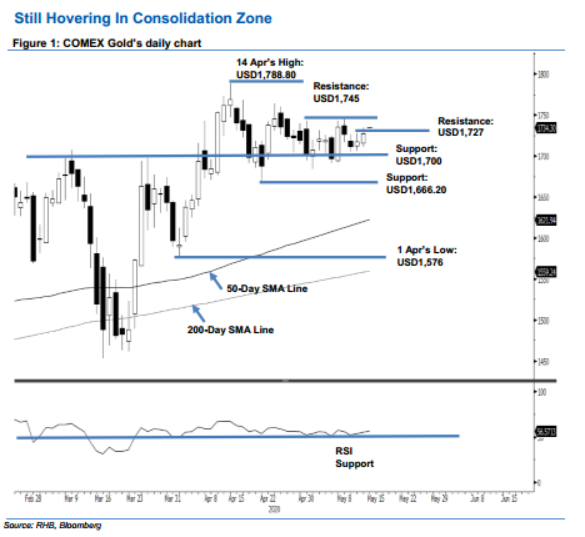

No breakaway from the consolidation zone yet; maintain short positions. The COMEX Gold again attempted to cross the USD1,727 immediate resistance in the latest session, as it reached a high of USD1,734.90 – before closing USD9.60 higher at USD1,726.90. The commodity has been trading in a relatively narrow zone of around USD1,700 and USD1,745 over the latest two weeks – this implies the ongoing consolation phase which kicked in after the precious metal reached a high of USD1,788.80 on 14 Apr is still in place. Towards the downside, should the USD1,700 resistance-turned-support be breached, the risk for further decline would be higher. Maintain our negative trading bias.

We advise traders to stay in short positions. These were initiated at USD1,701, or the closing level of 30 Apr. For risk-management purposes, a stop-loss can be placed above the USD1,745 threshold.

We are keeping the immediate support at the USD1,700.00 round figure. This is followed by USD1,666.20, or the low of 21 Apr. Moving up, the immediate resistance is set at USD1,727.00 – near 11 May’s high – and followed by USD1,745.00, ie near the high of 30 Apr.

Source: RHB Securities Research - 14 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024