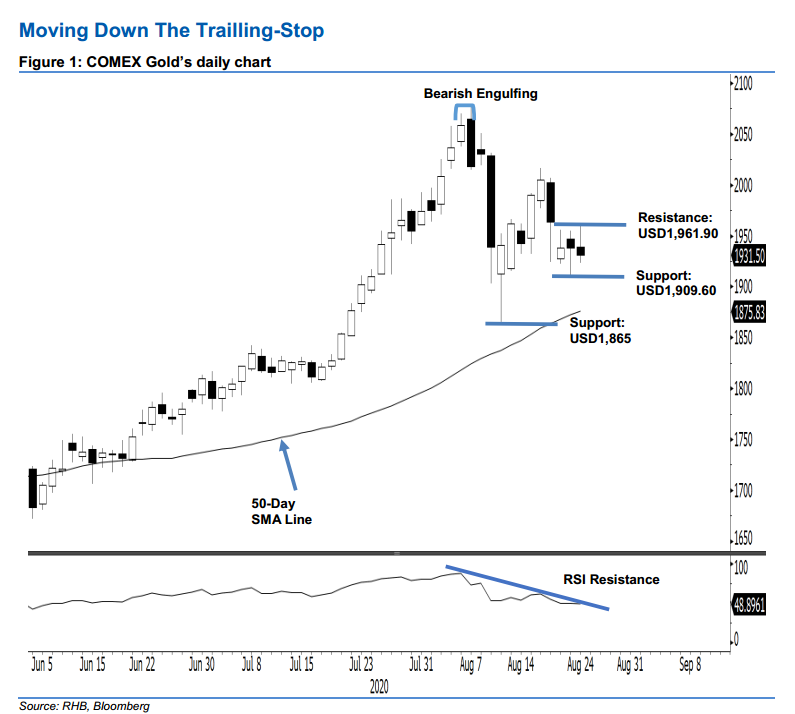

COMEX Gold - Moving Down the Trailling-Stop

rhboskres

Publish date: Tue, 25 Aug 2020, 10:28 PM

Maintain short positions while placing the trailing-stop at the breakeven mark. The COMEX Gold experienced a sharp negative intraday price reversal, as it slid from a high of USD1,961.5 to a USD1,923 low before ending USD6.80 lower at USD1,931.5. The latest session’s price action suggests that the precious metal was attempting to extend its counter-trend rebound, which had been in development from 12 Aug’s USD1,865 low. Until we see such signals appearing, we keep to our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD1,938.90, which was the closing level of 10 Aug. For risk-management purposes, a stop-loss can now be placed at the breakeven mark.

The immediate support is revised to USD1,923, which was the latest low. This is followed by the USD1,909.60 level, ie the low of 21 Aug. Moving up, the resistance levels are marked at the USD1,950 and USD1,961.90 thresholds – both are the latest session’s price points.

Source: RHB Securities Research - 25 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024