FCPO - Profit-Taking Sets In

rhboskres

Publish date: Thu, 27 Aug 2020, 10:10 PM

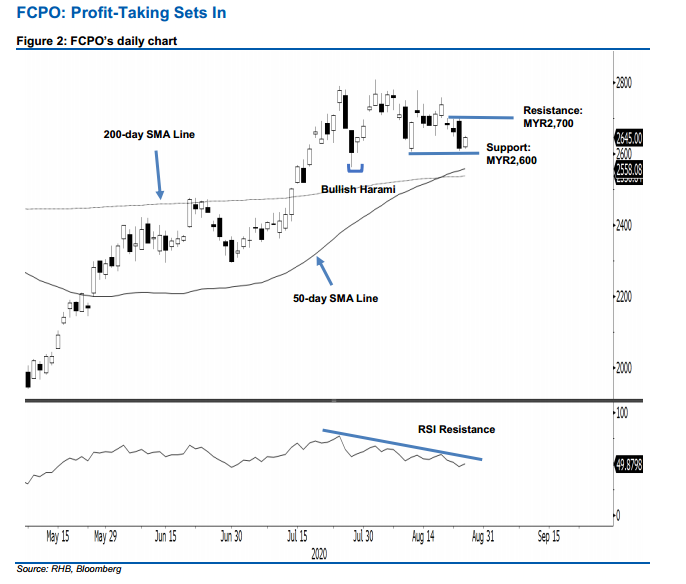

Maintain short positions. The FCPO closed MYR30.00 stronger, at MYR2,645. Consequently, a “Bullish Harami” formation appeared. We see the positive performance as a likely result of profit-taking activity, following the declines that were recorded in prior sessions. Broadly, the FCPO is still likely trading in a correction phase. This is further supported by the RSI reading, which remains capped by the resistance line and is not showing any sign of reversing. We maintain our negative trading bias.

We recommend that traders stay in short positions. We initiated these at MYR2,615, the closing level of 25 Aug. To manage risks, a stop-loss can be placed above MYR2,700.

The immediate support is pegged at MYR2,600, followed by MYR2,562 – the low of 28 Jul. Moving up, the immediate resistance is set at MYR2,685, followed by MYR2,700.

Source: RHB Securities Research - 27 Aug 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024