Hang Seng Index Futures - Waiting for Reversal Confirmation

rhboskres

Publish date: Wed, 02 Sep 2020, 11:26 AM

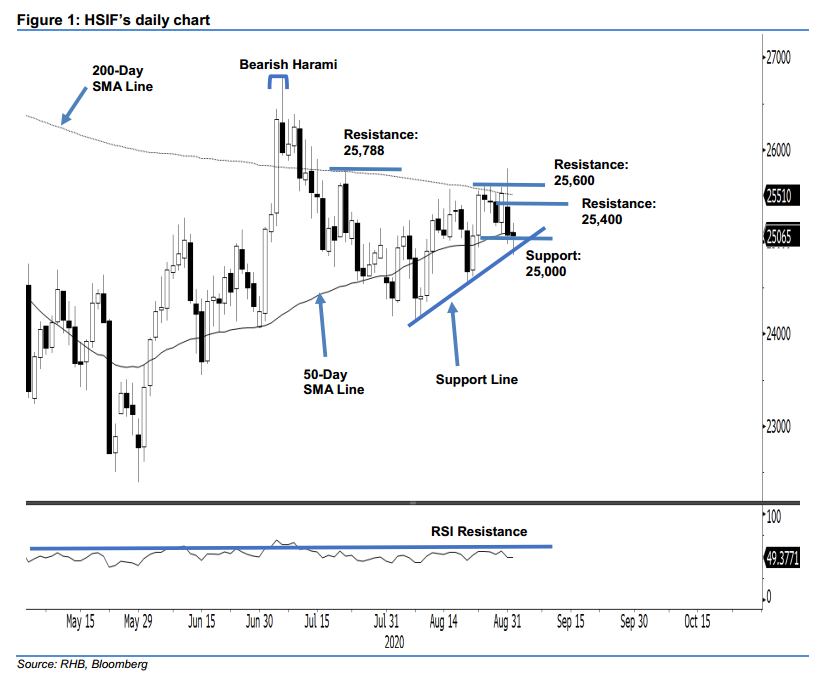

Maintain long positions. The HSIF rebounded from an intraday low of 24,851 pts to close at 25,065 pts, representing a mild 10-pt decline. The sharp intraday rebound that happened after the index tested the support line (as drawn in the chart) came after the HSIF experienced a relatively sharp decline following a failed attempt to cross a resistance zone made up of 25,600 pts – a level located near the 200-day SMA line – and 25,788 pts. Until further negative price actions are observed, we are keeping to our positive trading bias.

We advise traders to stay in long positions, which we initiated at 25,235 pts, ie the closing level of 12 Aug. For riskmanagement purposes, a stop-loss can now be placed below the 25,000-pt threshold.

The immediate support is revised to the 25,000-pt mark, ie a round figure that is also near the 50-day SMA line. This is followed by 24,851 pts, or the latest low. Conversely, the immediate resistance is now set at 25,400 pts, which is followed by the 25,600-pt mark, or near the 200-day SMA line.

Source: RHB Securities Research - 2 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024