FKLI - Moving Lower Trailing-Stop

rhboskres

Publish date: Fri, 25 Sep 2020, 06:23 PM

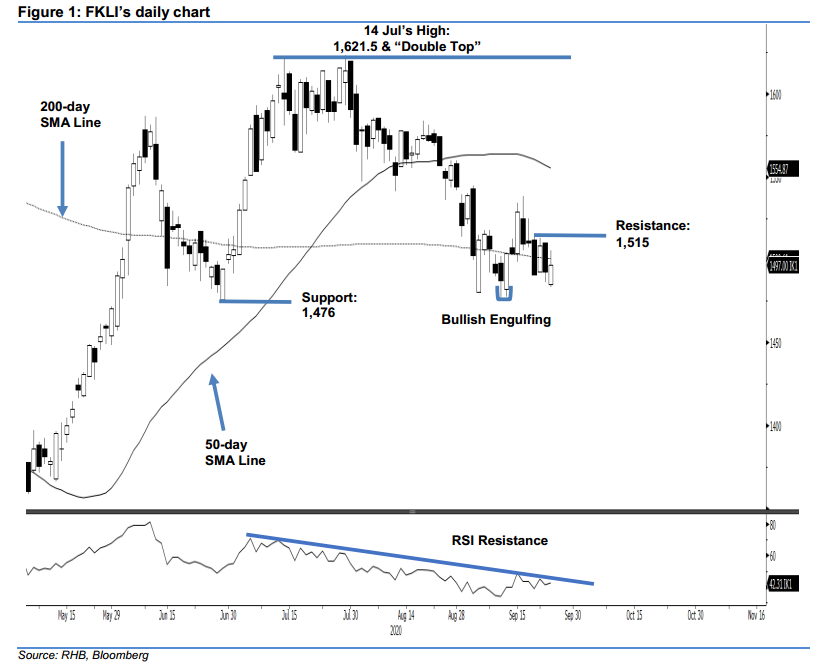

Stick to short positions. The FKLI underwent a positive price reversal to close 4.5 pts higher, at 1,497 pts, yesterday. Early in the session, it hit a low of 1,483.5 pts. This can be regarded as part of its rangebound movement – the index has been trading around the 200-day SMA line in the latest four sessions. Breaching the 1,476-pt level would open the door for a deeper correction. Meanwhile, on the upside, if the FKLI crosses above 1,515 pts, it would stand a greater chance of staging a rebound extension. For now, we are maintaining a negative trading bias.

We advise traders to remain in short positions. We initiated these at 1,491 pts, the closing level of 21 Sep. To manage risks, a stop-loss can be set above 1,515 pts.

The immediate support is revised to 1,483.5 pts, the latest low. This is followed by 1,476 pts, the low of 29 Jun. Towards the upside, the resistance points are pegged at 1,500 pts and 1,515 pts.

Source: RHB Securities Research - 25 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024