Hang Seng Index Futures - Downtrend Continues Amid Being Oversold

rhboskres

Publish date: Mon, 28 Sep 2020, 10:47 AM

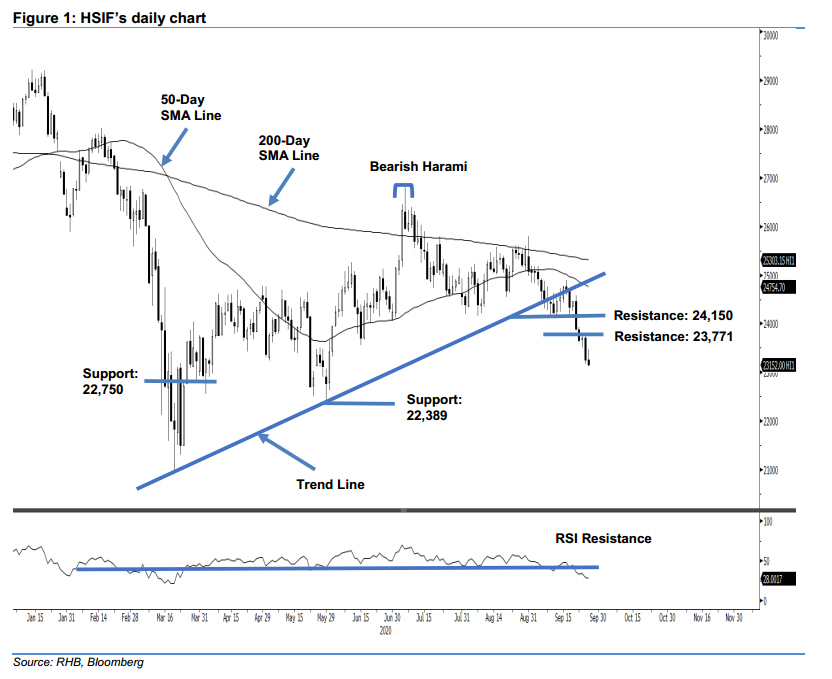

Maintain short positions. The HSIF continued its downward trend, falling 100 pts to end the session at 23,152 pts. During the session, it attempted to move higher to test the 23,475-pt mark, but momentum fizzled, and it closed in negative territory. Observe that the 50-day SMA line is turning south, indicating that the bearish trend is still in control. However, since the gap between HSIF and the 50-day SMA line has widened, there is a possibility of the HSIF rebounding in the near term to test its upper resistance level, due to being oversold. In conclusion, we are keeping to our negative trading bias until the resistance level is breached.

We advise traders to stay in short positions. We initiated these at 24,924 pts, which was the closing level of 3 Sep. For risk-management purposes, we move the trailing stop-loss lower to the 23,771-pt mark, which was the day high of 24 Sep.

The support level is set at 22,750 pts, ie the low of 30 Mar. This is followed by the 22,389-pt mark, which was the day low of 29 May. Moving up, the immediate resistance is set at 23,771 pts, followed by 24,150 pts.

Source: RHB Securities Research - 28 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024