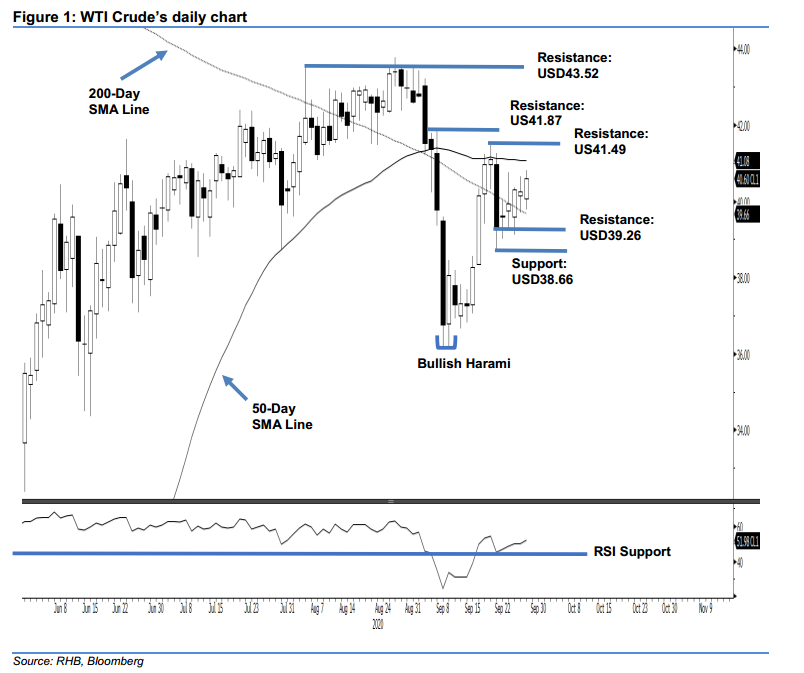

WTI Crude - Firming Up Above the 50-Day SMALine

rhboskres

Publish date: Tue, 29 Sep 2020, 10:28 AM

Maintain long positions. The WTI Crude traded in the USD39.78-40.60 range, slightly above the 50-day SMA line, before closing USD0.35 higher at USD40.60. Price actions over the past week indicate that the bulls are still attempting to push prices higher following the sharp 1-day decline on 21 Sep. Price performances in the coming sessions in the zone that comprises the 50- and 200-day SMA lines are crucial in signalling the commodity’s next price directional bias. A downside breach of USD39.26 will invalidate our current positive trading bias.

We retain our recommendation for traders to stay in long positions. We initiated these at USD40.16, which was the closing level of 16 Sep. To manage risks, a stop-loss can be placed below the USD39.26 level.

We are keeping the immediate support target at USD39.26 – the low of 23 Sep – and followed by USD38.66, which was the low of 21 Sep. The immediate resistance is revised to USD41.49, or the high of 18 Sep. This is followed by USD41.87, ie the high of 4 Sep.

Source: RHB Securities Research - 29 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024