COMEX Gold - Reversal Formation Pending Confirmation

rhboskres

Publish date: Tue, 29 Sep 2020, 10:30 AM

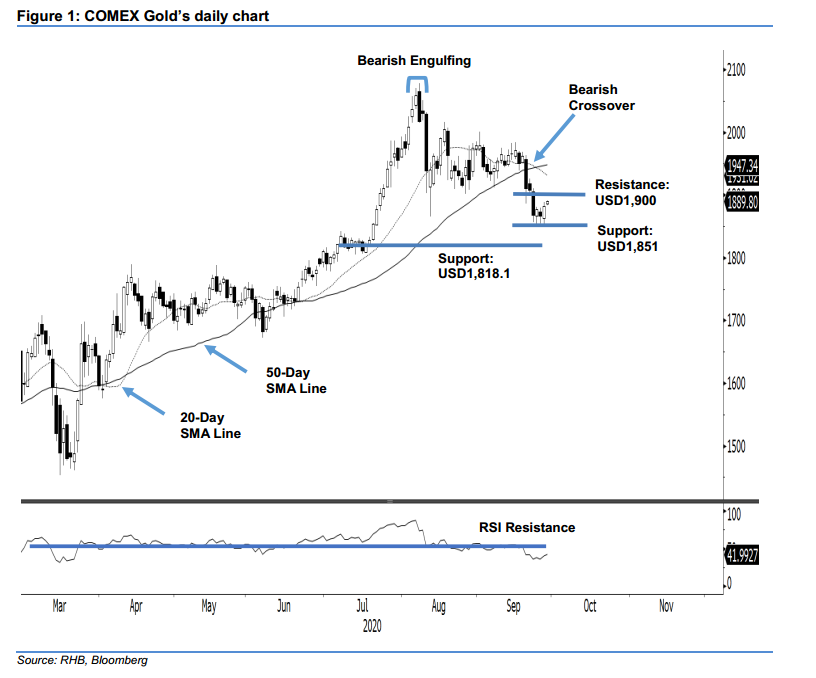

Maintain short positions. The COMEX Gold tested the previous USD1,865 support level and added USD16.00 to close at USD1,882.30. For the past four sessions, there was likely an interim support level formed at USD1,851. During the latest session, it closed with a white candle, coupled with the RSI pointing upwards – indicating that momentum picked up and is ready to reverse higher to test resistance levels. However, a bearish crossover of the 20-day and 50-day SMA lines on 22 Sep showed the bears are still in control. We see that the recent price action might turn out to be a short-lived countertrend upward movement. Maintain our negative trading bias.

We recommend traders maintain short positions. We initiated these at USD1,910.60 – the closing level of 21 Sep. For risk-management purposes, and to protect our trading profits, we move the stop-loss level lower to the USD1898.90 mark, which is the low of 22 Sep.

The immediate support is at USD1,851, or the low of 24 Sep. This is followed by USD1,818.10 – which is the low of 20 Jul. Moving up, the immediate resistance is sighted at USD1,900, the round number level, followed by USD1,911.70 – the low of 8 Sep’s candle.

Source: RHB Securities Research - 29 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024