E-Mini Dow - Resistance Lines Are Capping the Bulls

rhboskres

Publish date: Wed, 30 Sep 2020, 04:28 PM

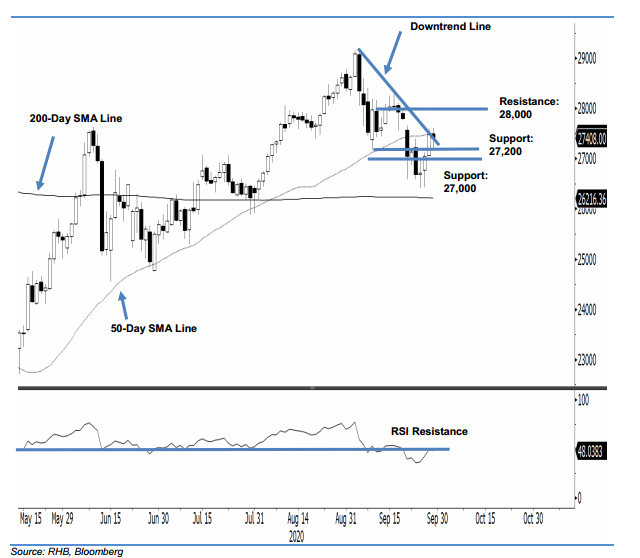

Maintain short positions while moving down the trailing-stop. The E-mini Dow has ended its three sessions of advancement, which saw it rebounding around 1,200 pts from the recent 26,407-pt low. At the close, the index softened 74 pts at 27,408 pts. It has been attempting to cross above the 50-day and multi-week downtrend lines over the past two sessions. Price actions around these lines are crucial – a rejection from these lines could see the multi-week correction phase extending, potentially seeing the E-mini Dow testing the 200-day SMA line. Meanwhile, an upside breach of these lines could see the index resuming its multi-month uptrend. For now, we are keeping to our negative trading bias.

We recommend traders stay in short positions and initiated these at 27,525 pts, or the closing level of 8 Sep. For risk-management purposes, a stop-loss can now be placed above the 28,000-pt mark. The immediate support is maintained at 27,200 pts – a price point of 28 Sep. This is followed by the 27,000-pt round figure.

The immediate resistance is set at the 28,000-pt round figure and followed by 28,367 pts, which was the high of 16 Sep.

Source: RHB Securities Research - 30 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024