COMEX Gold - Reversal Formation Confirmed

rhboskres

Publish date: Wed, 30 Sep 2020, 04:41 PM

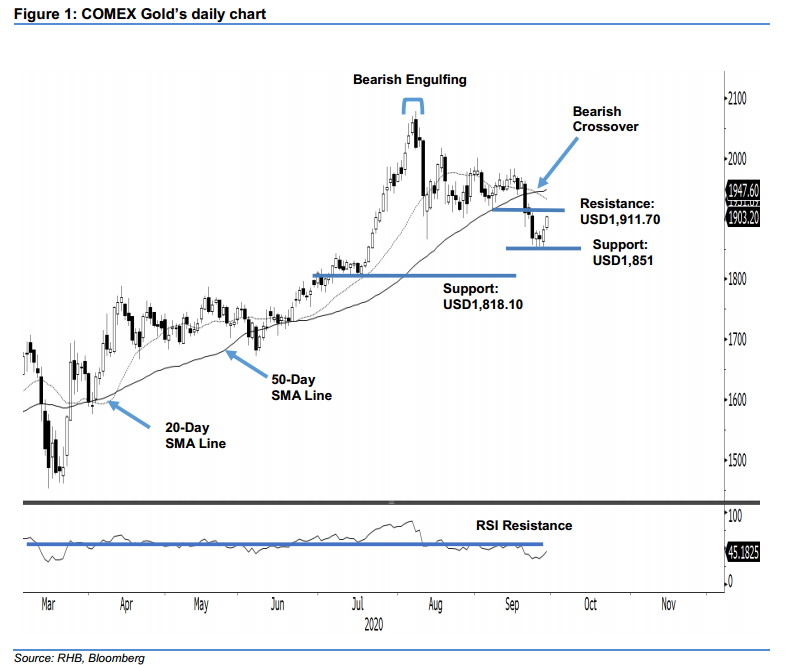

Initiate long positions for reversal. The COMEX Gold has breached our USD1,898.90 stop-loss level, rising USD20.90 to settle at USD1,903.20. With a strong white candle formed – coupled with the RSI pointing upwards – we think the momentum will continue to drive the rebound towards the 20-day SMA line. If – in the coming session – the RSI can reach above the 50% threshold level, then it has a high probability of testing the 50-day SMA line. The counter-trend momentum will last as long the nearest support level is maintained. We change our view to a mild positive trading bias.

We recommend traders move into long positions. We initiated such positions at USD1,903.20, ie the closing level of 29 Sep. For risk-management purposes, we set the stop-loss level at the USD1,851 mark, which was the low of 24 Sep.

The nearest support is at USD1,851, and followed by USD1,818.10 – which is the low of 20 Jul. Moving up, the immediate resistance is marked at USD1,911.70 and followed by USD1,968.20, or the high of 18 Sep’s candle.

Source: RHB Securities Research - 30 Sept 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024