FKLI - Developing A Sideways Trading Range

rhboskres

Publish date: Thu, 01 Oct 2020, 04:39 PM

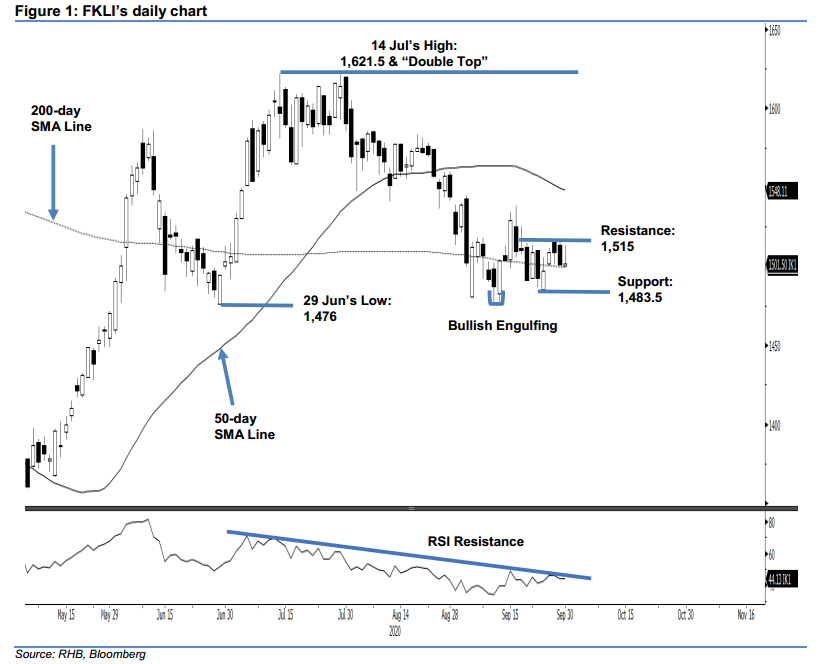

No signal for a stronger rebound phase; maintain short positions. The FKLI traded in the range of 1,500-1,514.5 pts in the latest session, before closing at 1,501.5 pts, thus extending its sideways trading range into the fourth session. Based on the four sessions’ price actions, an upside breach of the 1,515-pt resistance will likely see the index extending its rebound, which set in following the 11 Sep’s “Bullish Engulfing” formation. Meanwhile, a downside breach of the round figure of 1,500 pts could open the door for the index to retest the low of the abovementioned “Bullish Engulfing” formation. For now, we are keeping our negative trading bias.

Until prospects of a stronger rebound are confirmed, we advise traders to remain in short positions. We initiated these at 1,491 pts, the closing level of 21 Sep. To manage risks, a stop-loss can be set above 1,515 pts.

We are still eying the immediate support at the round figure of 1,500 pts, followed by 1,483.5 pts, the low of 24 Sep. Towards the upside, the resistance points are set at 1,515 pts and 1,525 pts.

Source: RHB Securities Research - 1 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024