WTI Crude - Back Into the Resistance Zone

rhboskres

Publish date: Thu, 01 Oct 2020, 04:47 PM

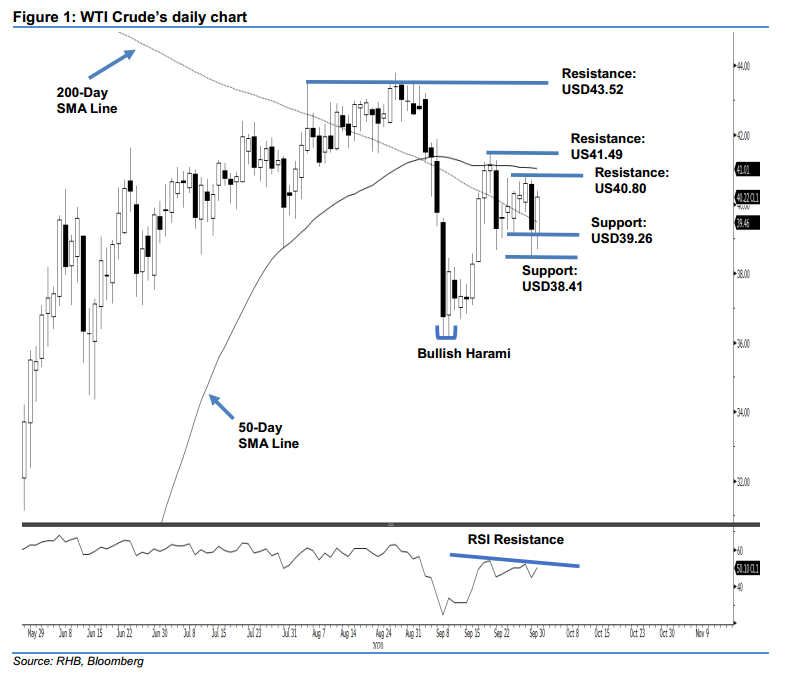

Maintain long positions. The WTI Crude ended the latest session on a strong footing, gaining USD0.98 to close at USD40.22, and pushing prices back into the resistance zone, which consists of the 50- and 200-day SMA lines. The positive performance has also nullified the prior session’s black candle. Looking at the bigger picture, the commodity is now showing signs of developing a sideways trading pattern around the abovementioned SMA lines, following its sharp rebound between 9-19 Sep. We believe it is now ready to extend its rebound, at the very minimum, to retest the USD41.49 resistance point. We maintain our positive trading bias.

We retain our recommendation for traders to stay in long positions. We initiated these at USD40.16, which was the closing level of 16 Sep. To manage risks, a stop-loss can be placed below the USD39.26 level.

Immediate support is maintained at USD39.26 – the low of 23 Sep – and followed by USD38.41, which was the low of 29 Sep. The immediate resistance is eyed at USD40.80, ie the high of 28 Sep. This is followed by USD41.49, or the high of 18 Sep.

Source: RHB Securities Research - 1 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024