FKLI - Breakdown From Sideways Range

rhboskres

Publish date: Fri, 02 Oct 2020, 04:51 PM

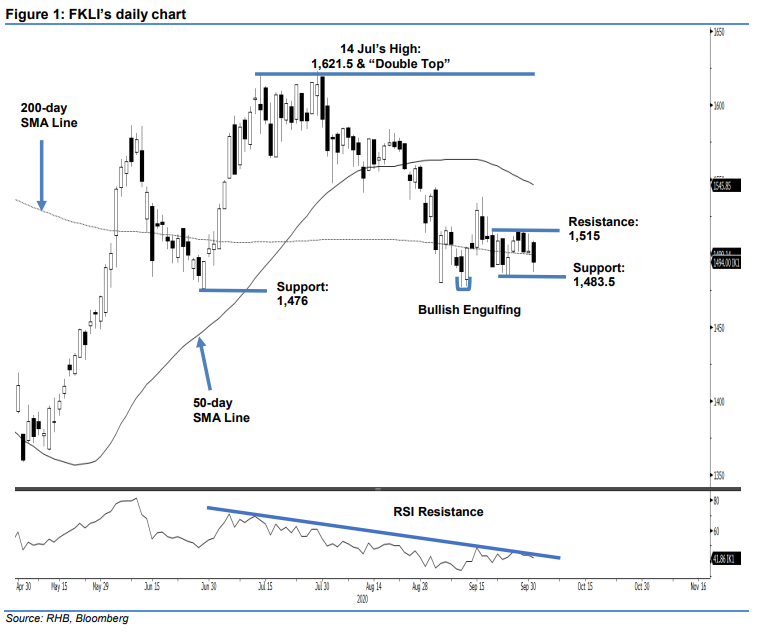

Maintain short positions. The FKLI closed 9.5 pts lower at 1,494 pts yesterday, dropping out of the previous multisession sideways trading range of 1,500-1,515 pts as well as the 50-day SMA line, albeit marginally. The breakdowns are technically negative. They also indicate that the risk is high that the index could, at the minimum, retest the low of 11 Sep’s “Bullish Engulfing” formation. In addition, the momentum was weak, and the RSI remains capped by the resistance line (as drawn in the chart). Premised on this, we are maintaining a negative trading bias

Until prospects of a stronger rebound are confirmed, we advise traders to remain in short positions. We initiated these at 1,491 pts, the closing level of 21 Sep. To manage risks, a stop-loss can be set above 1,515 pts.

The immediate resistance is revised to 1,483.5 pts, the low of 24 Sep. This is followed by 1,476 pts, the low of 29 Jun. Meanwhile, resistance levels are marked at 1,500 pts, followed by 1,515 pts.

Source: RHB Securities Research - 2 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024