WTI Crude - Dropping Out of the Resistance Zone Again

rhboskres

Publish date: Fri, 02 Oct 2020, 05:01 PM

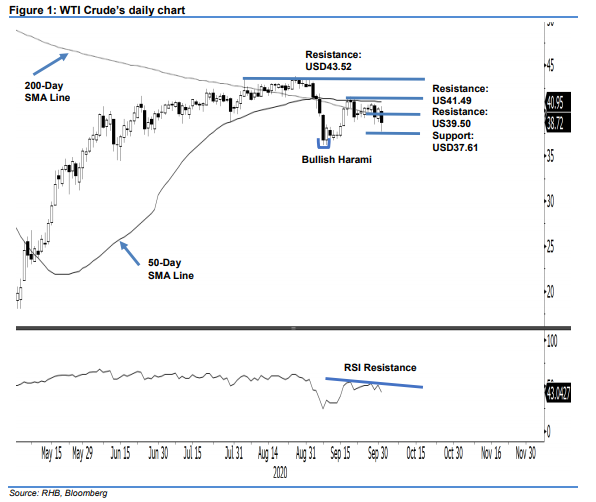

Initiate short positions. The WTI Crude failed to maintain its two-week sideways trading range around the 50- and 200-day SMA lines during the latest session. After hitting a low and high of USD37.61 and USD40.47, the black gold settled USD1.50 lower at USD38.82. Consequently, this nullifies our previous expectation for it to extend its rebound and test the USD41.49 resistance point. With the price rejection from these lines, chances are high that the commodity is in the process of resuming its retracement, which began at the end of August. We switch our trading bias from positive to negative.

Our previous long positions, initiated at USD40.16, were closed out at USD39.26 in the latest session. Concurrently, we initiate long positions. To manage risks, a stop-loss can be placed above the USD39.50 mark.

Immediate support is revised to USD37.61, which is the latest low. This is followed by USD36.13 , or the low of 9 Sep’s “Bullish Harami”. Moving up, immediate resistance is eyed at USD39.50, followed by USD41.49 – the high of 18 Sep.

Source: RHB Securities Research - 2 Oct 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024