WTI Crude - Nearing the 200-Day SMA Line

rhboskres

Publish date: Thu, 05 Nov 2020, 05:36 PM

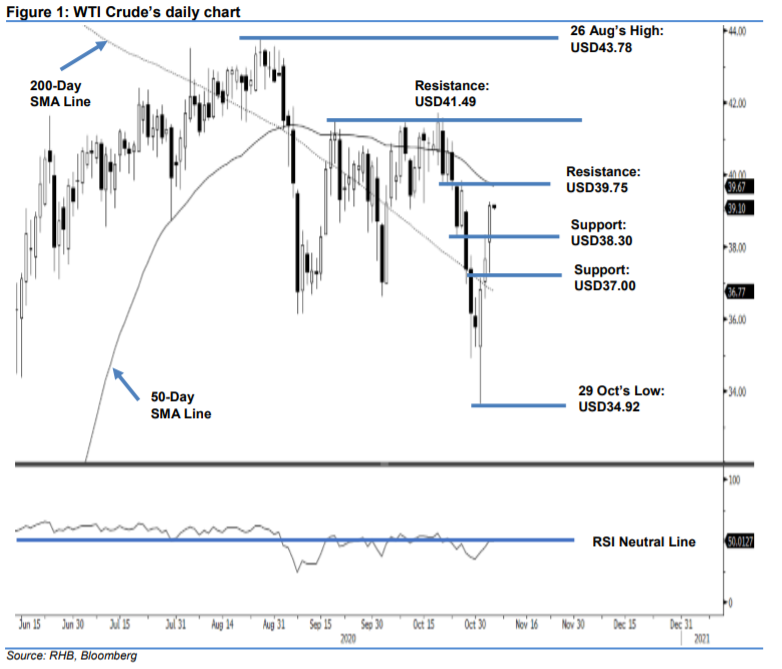

Initiate long positions, as rebound is stronger than expected. The WTI Crude continued to advance strongly for the third session, ending USD1.49 higher at USD39.15 – crossing above the previous immediate resistance of USD38.28. The positive performance has also pushed prices comfortably above the 50-day SMA line, placing the black gold close to testing the 200-day SMA line. Addtionally, the RSI continued to improve, and is now back to the neutral level of 50. Premised on these, we switch our trading bias from negative to positive.

Our previous short positions, initiated at USD39.85, or the closing level of 23 Oct, were closed out in the latest session. Concurrently, we initiate long positions at the latest close. To manage risks, a stop-loss can be placed below USD37.00.

The support level is revised to USD38.30, followed by USD37.00. On the upside, the immediate resistance is eyed at USD39.75 – near the 200-day SMA line. This is followed by USD41.49, which was the high of 18 Sep.

Source: RHB Securities Research - 10 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024