WTI Crude - Moving Up Stop-Loss

rhboskres

Publish date: Fri, 06 Nov 2020, 06:16 PM

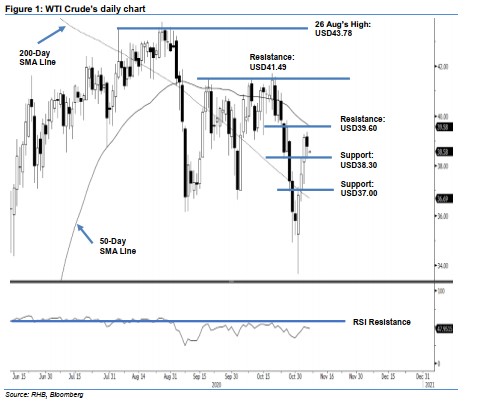

Maintain long positions. Yesterday, the WTI Crude was unable to sustain its intraday gains. It reached a high of USD39.35, before sliding lower to end the session USD0.36 softer, at USD38.79. The negative intraday price reversal could be an early indication that the commodity is developing a minor consolidation in the region below the 50-day SMA line, following its recent sessions’ sharp rebound. Towards the downside – provided the immediate support of USD38.30 does not fail at the closing – the risk of a deeper correction developing would be contained. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD39.15 – the closing level of 4 Nov. To manage risks, a stop-loss can now be placed below the USD38.30 mark.

The immediate support level is revised to USD38.30, followed by USD37.00. On the upside, the immediate resistance is eyed at USD39.60 – near the 50-day SMA line. This is followed by USD41.49, which was the high of 18 Sep

Source: RHB Securities Research - 6 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024