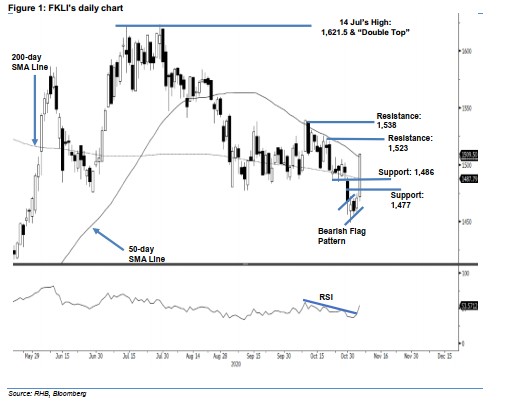

FKLI- Jump Above 200-day SMA Line

rhboskres

Publish date: Fri, 06 Nov 2020, 06:24 PM

Bulls broke past resistance; initiate long positions. The FKLI surged higher during Thursday’s session, rising 38 pts to settle at 1,509 pts. The index started the session at 1,472 pts, and briefly traded at a session low of 1,467.5 pts before it broke out from the upper boundary of the flag pattern. During the session, it broke past the previous resistance of 1,488.5 pts, climbed above the 200-day SMA line, and concluded the session at a day high. The bullish momentum had outperformed the bears. With the RSI trending above the 50% threshold, we think the bullish momentum will continue and it may attempt to cross the 50-day SMA line in coming sessions. With such strong buying interest emerging, we switch our negative trading bias to positive.

Our previous short positions, initiated at 1,510 pts – the closing level of 12 Oct – were closed out during the latest session at 1488.5 pts. Concurrently, we initiate long positions. To manage risks, a stop-loss is set below the 1,477-pt mark, the low of 10 Sep.

The immediate support is revised to 1,486 pts, the low of 22 Oct, followed by 1,477 pts. On the upside, the immediate resistance is sighted at 1,523 pts, followed by 1,538 pts, ie the high of 12 Oct.

Source: RHB Securities Research - 6 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024