WTI Crude- a Potential Reversal

rhboskres

Publish date: Mon, 09 Nov 2020, 10:49 AM

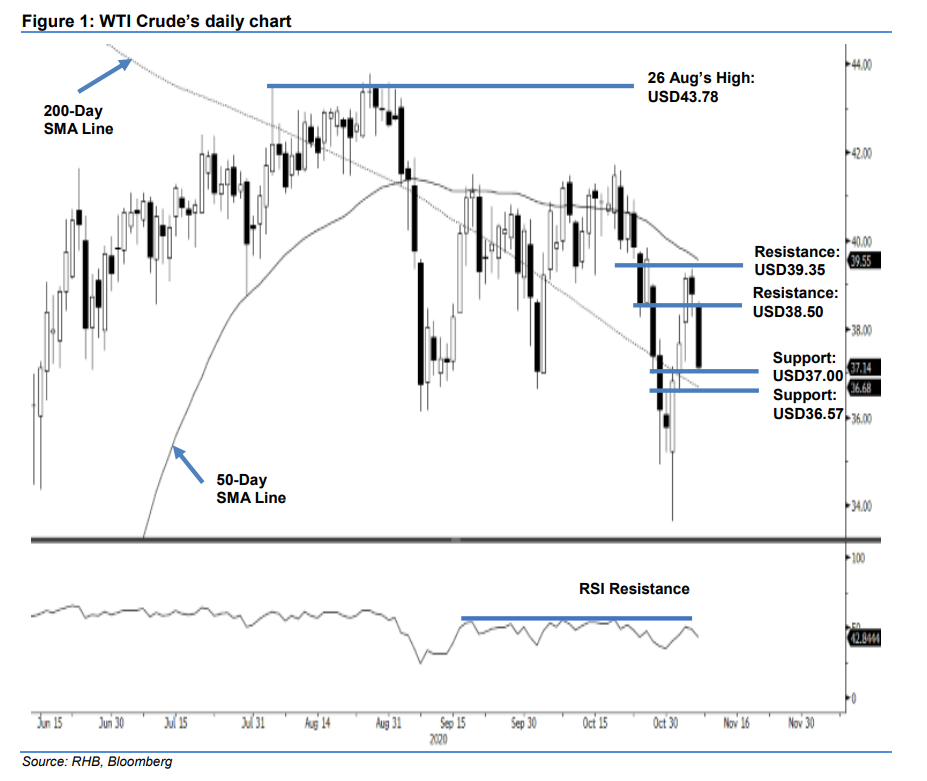

Initiate short positions. Last Friday, the WTI Crude formed a black candle to settle USD1.65 lower at USD37.14. This can be seen as a continuation from the prior session’s negative intraday price reversal, which took place near the 50-day SMA line. These weak closings are likely an indication that the black gold’s rebound – off the low of USD33.64 recorded on 2 Nov – has reached its top, and that the correction phase which started early-September, has resumed. Towards the downside, we expect prices to retest 2 Nov’s low of USD33.64. Hence, we switch our trading bias from positive to negative.

Our previous long positions initiated at USD39.15 – the closing level of 4 Nov – were closed out at USD38.30 during Friday’s session. Concurrently, we initiate short positions. To manage risks, a stop-loss can be placed above USD39.35.

The immediate support level is revised to USD37.00, followed by USD36.57 – the low of 3 Nov. Moving up, the immediate resistance now pegged at USD38.50, followed by 5 Nov’s high of USD39.35.

Source: RHB Securities Research - 9 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024