FKLI- Extending Higher

rhboskres

Publish date: Mon, 09 Nov 2020, 10:49 AM

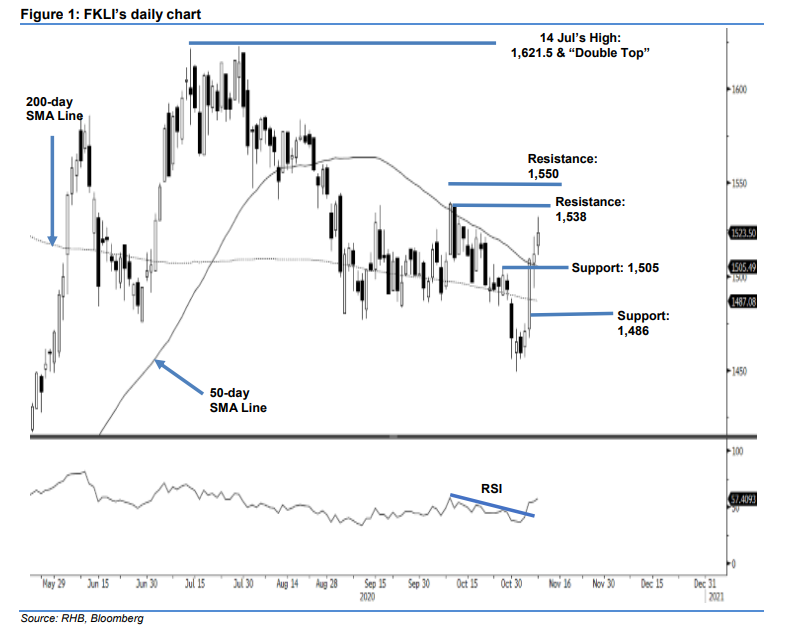

Maintain long positions. FKLI continued to rise on Monday’s session, buoyed by risk-on sentiments or short-covering activities. The index started the session at 1,516.5 pts and within a short span of time, it surged to 1,532 pts. However, during mid-day, the momentum faltered and fell into negative territory or the session’s low of 1,511.5 pts. Towards the end of the trading hour, buying interest returned and pushed the index to close higher at 1,523.5 pts. Despite the volatile session, the index managed to add 11.5 pts compared to the previous session, with the uptrend still intact. Although there was some selling pressure during intraday, it lacked follow-through. With the RSI indicator still trending above 50%, we maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at 1,509 pts, which is the closing level of 5 Nov. To limit downside risks, we revised the stop-loss to the break-even level.

The immediate support is set at 1,505 pts – the high of 27 Oct, followed by 1,486 pts. On the upside, the immediate resistance is pegged higher at 1,538 pts, ie the high of 12 Oct, followed by 1,550 pts.

Source: RHB Securities Research - 9 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024