WTI Crude - Rebound Holding on

rhboskres

Publish date: Tue, 10 Nov 2020, 10:48 AM

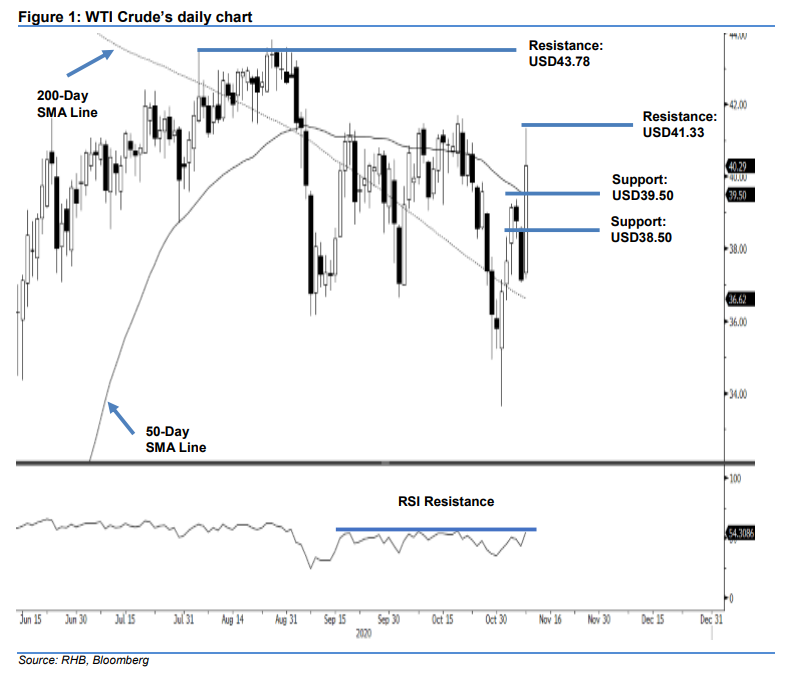

Initiate long positions. The WTI Crude is nullifying our expectations of it resuming its multi-week retracement phase. It formed a white candle to hit a high of USD41.33 before ending USD3.15 higher at USD40.29 – which was also above the 200-day SMA line. The RSI is also coming near to breaking above the resistance line, as drawn in the chart, which – if it happens – will be a positive technical observation. The positive performance suggests the sharp rebound off 2 Nov’s USD33.64 low may still be able to extend further. This positive expectation should stay, provided the USD38.50 support level continues to hold. We switch our trading bias to positive from negative.

Our previous long positions were initiated at USD37.14, with 6 Nov’s closing level closed out at USD39.35 during the latest session. Concurrently, we initiate long positions. To manage risks, a stop-loss can be placed below the USD38.50 threshold.

The immediate support level is revised to USD39.50 – near the 200-day SMA line. This is followed by USD38.50. On the upside, the immediate resistance is pegged at USD41.43, ie the latest session’s high. Breaking this could see the black gold test 26 Aug’s USD43.78 high

Source: RHB Securities Research - 10 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024