WTI Crude - Bulls Are Hitting a Wall

rhboskres

Publish date: Thu, 19 Nov 2020, 05:58 PM

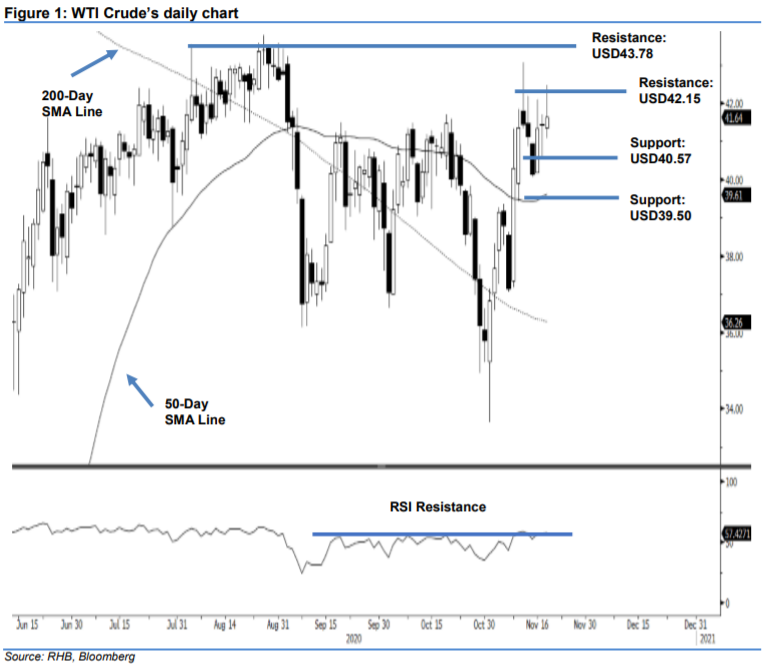

Maintain short positions. The WTI Crude managed to register a USD0.21 gain to settle at USD41.64. However, the performance was not impressive, as the commodity – on an intraday basis – was rejected from the USD42.15 resistance after hitting a high of USD42.46. The price rejection was an indication that the correction phase, which started from last week, remains incomplete. We also think the bias is strong and that, in the coming sessions, the commodity’s prices are likely to retrace towards the 200-day SMA line. Addtionally, the RSI continues to struggle to decisively overcome its resistance. Hence, we are keeping our negative trading bias.

We recommend traders stay in short positions. We initiated these at USD40.13, or the closing level of 13 Nov. To manage risks, a stop-loss can be placed above the USD43.78 threshold.

We revise the support level to USD40.57, being 17 Nov’s low. This is followed by USD39.50, which is near the 50- day SMA line. A resistance point is maintained at USD42.15 and followed by USD43.78 – the high of 26 Aug.

Source: RHB Securities Research - 19 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024