FKLI - Hovering At 1,600 Pts

rhboskres

Publish date: Mon, 23 Nov 2020, 10:53 AM

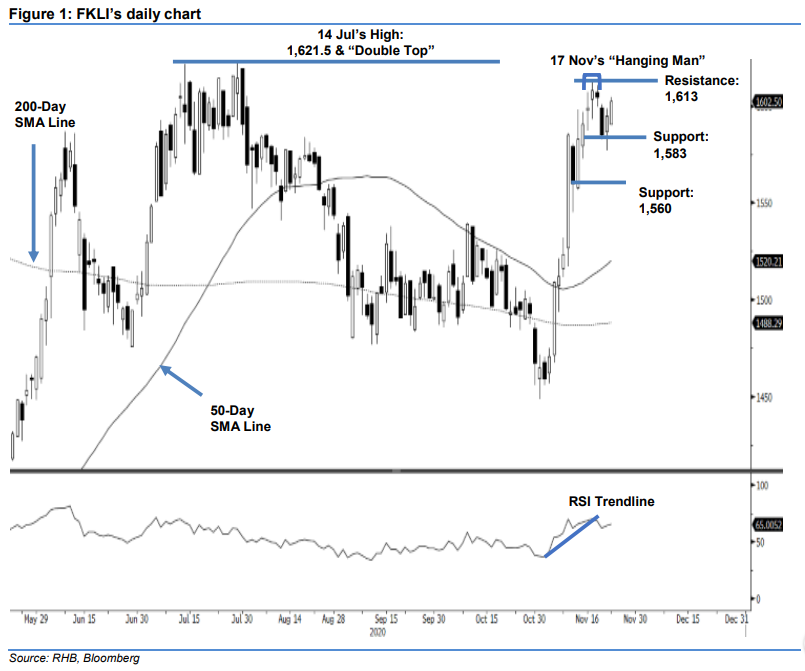

Maintain long positions. The FKLI crawled above the physcological level of 1,600 pts, to settle at 1,602.5 pts. It opened 4 pts lower, at 1,590.5 pts. Despite the weak opening, the index saw strong buying interest, jumping to the session’s high of 1,604.5 within 15 minutes of the start of the morning session. The selling pressure was fully absorbed by the bulls and saw the index hover near 1,600 pts until it closed at 1,602.5 pts. As we highlighted yesterday, the index will likely test the high of 17 Nov, after reaching the 1,600-pt mark. If the Hanging Man pattern at the 1,613-pt mark is taken out, the index will challenge the resistance left by the Double Top. These expectations will remain valid as long as the immediate support level stays intact. With the latest positive price action, we maintain our positive trading bias.

We recommend that traders remain in long positions. We initiated these at 1,590.5 pts, the closing level of 13 Nov. To manage risks, a stop-loss can be placed below 1,577 pts.

The immediate support is marked at 1,583 pts and followed by 1,560 pts. Towards the upside, the immediate resistance is pegged at the high of 17 Nov, ie 1,613 pts and followed by the Double Top of 1,621.5 pts

Source: RHB Securities Research - 23 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024