Hang Seng Index Futures - Bears Taking a Breather

rhboskres

Publish date: Tue, 02 Mar 2021, 09:16 AM

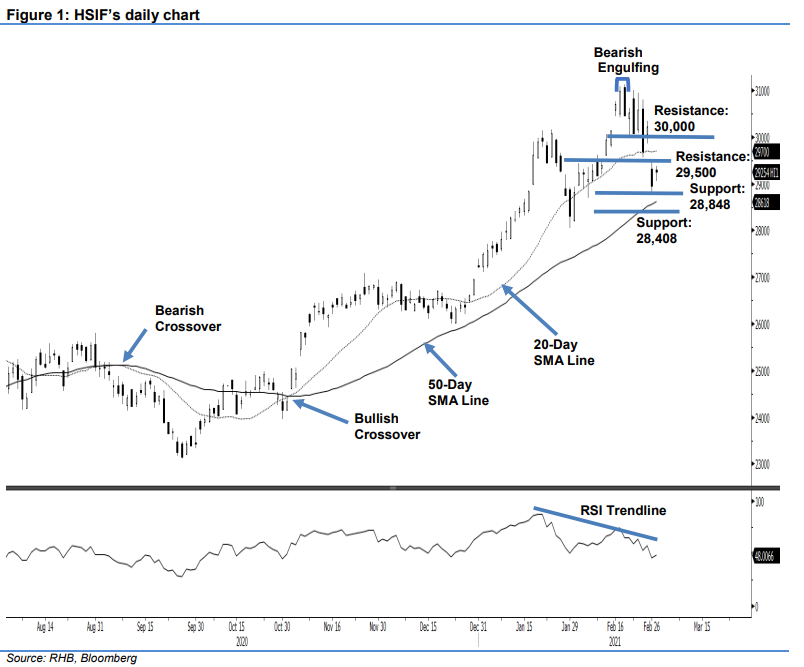

Maintain short positions. The HSIF saw a strong rebound yesterday, gaining 295 pts to settle at 29,254 pts. On Monday, it opened at 29,299 pts and dipped to the day’s low of 29,062 pts. Buying interest emerged near the day’s low, pushing the index towards the day’s 29,377-pt high, before it closed at 29,254 pts. In the evening, the index edged higher towards the session’s 29,419-pt high, and was last traded at 29,394 pts. If it manages to continue trending higher, on bullish momentum, the index may clear the immediate 29,500-pt resistance mark. While it displayed positive price action yesterday, we think the current correction phase is not over yet. Crossing above 29,700 pts may see the end of the correction phase, and resumption of the uptrend. Meanwhile, breaching below the 50-day SMA line may see further correction and downward movement. Pending completion of the correction phase, we maintain our negative trading bias.

We recommend traders keep the short positions initiated at 30,077 pts, or the closing level of 22 Feb. For risk management, the trailing-stop is set at 29,700 pts.

The immediate support is marked at 28,848 pts, followed by 13 Jan’s high of 28,408 pts. Towards the upside, the immediate resistance is pegged at the 29,500-pt round figure, followed by the 30,000-pt psychological level.

Source: RHB Securities Research - 2 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024