COMEX Gold - Falling Below the USD1,700 Threshold

rhboskres

Publish date: Mon, 08 Mar 2021, 08:49 AM

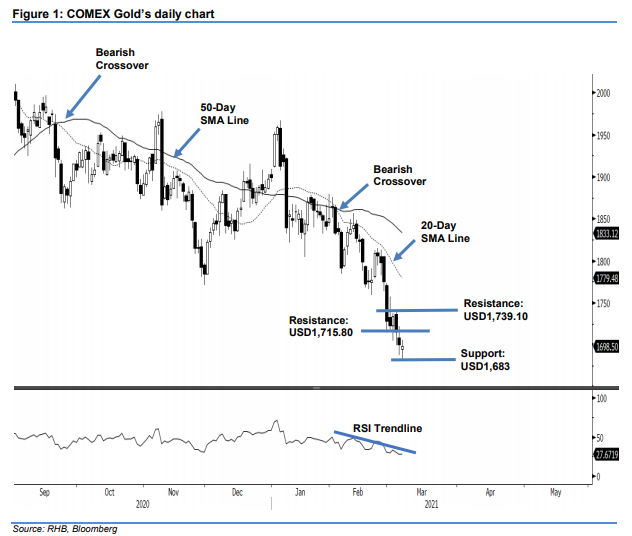

Maintain short positions. After breaching the USD1,700 mark, the COMEX Gold still struggled to find an interim bottom, declining USD2.20 to close at USD1698.50. It opened weaker last Friday at USD1,695.30. During the early session, it dipped to the session low of USD1,683 before rebounding to the USD1,705.70 session high. However, selling pressure persisted, dragging it to end the session lower at USD1,698.50. Observed: Based on the RSI indicator, the precious metal is now trading at an oversold level. We do not rule out the possibility of a technical rebound towards the 20-day SMA line. However, with the absence of a Bullish Reversal or long lower shadow candlestick pattern, which signifies strong buying interest, we maintain our negative trading bias.

We recommend traders stick to the short positions initiated at USD1,799, or the closing level of 16 Feb. For riskmanagement purposes, the trailing stop is revised to USD1,740.

The immediate support is revised to 5 March’s low of USD1,683 and followed by USD1,665. Towards the upside, the resistance is pegged at the closing price of 3 Mar – USD1,715.80 – and followed by the high of 3 Mar, ie USD1,739.10.

Source: RHB Securities Research - 8 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024