WTI Crude - Moving Up the Trailling Stop

rhboskres

Publish date: Mon, 08 Mar 2021, 09:06 AM

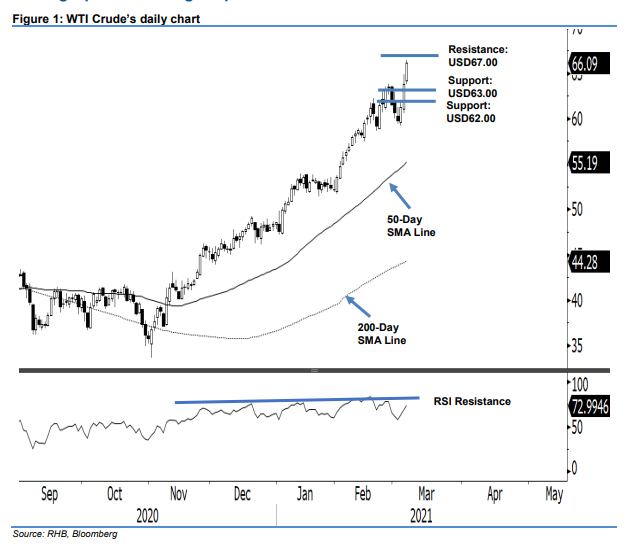

Maintain long positions. After a brief minor pause during the Asian trading hours, the WTI Crude resumed its upward charge on Friday. It ended USD2.26 stronger to close at USD66.09 – crossing above the USD65.00 resistance. The strong session was a positive surprise, given that we expected the commodity to develop a minor consolidation phase. While the RSI is again back at the overbought threshold, the price momentum remains in favour of the WTI Crude, which we believe is trading in a maturing “Ending Diagonal” pattern. Towards the downside, if the USD63.00 support is breached at the close, the possibility of a correction setting in will be high. For now, we are keeping to our positive trading bias while tightening up the risk management.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop loss can now be placed below the USD63.00 threshold.

Support levels are revised to USD63.00 and USD62.00. Moving up, the immediate resistance is now pegged at USD67.00 and followed by USD70.00.

Source: RHB Securities Research - 8 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024