FCPO - Attempting To Cross MYR3,800

rhboskres

Publish date: Mon, 08 Mar 2021, 09:12 AM

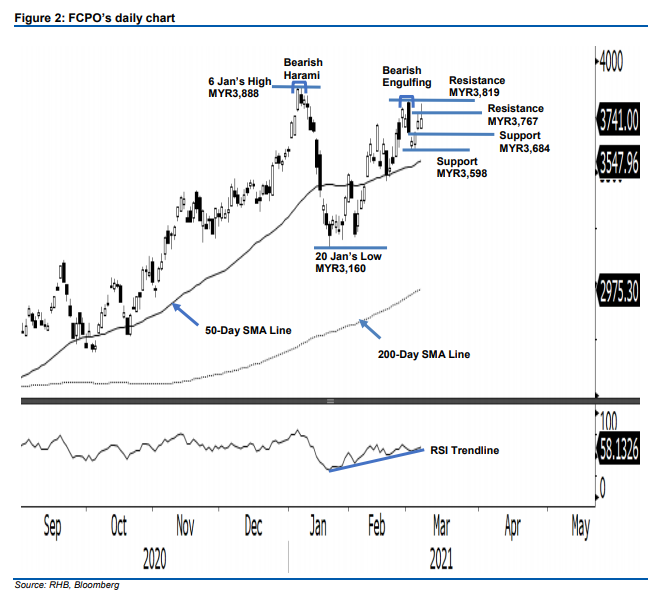

Maintain short positions. After filling the Breakaway Gap, the FCPO has continued to nudge higher for three consecutive sessions. At one time, the commodity breached the MYR3,800 level to reach the day’s high of MYR3,807, but buying pressure eased in the final trading hours, causing it to close at MYR3,741. The latest session still recorded a minor gain of MYR10 from the previous session. By leaving a long upper shadow candlestick formation on chart, this affirms our view that selling pressure is strong in range of MYR3,700-3,819. Failure to sustain above the MYR3,684 level will see the resumption of a downward correction. Meanwhile, if the bulls manage to clear the resistance marked at MYR3,819, this will warrant the commodity to trend higher and challenge the higher resistance of the Bearish Harami at MYR3,888. Since selling pressure will likely persist in the coming sessions, we stick to our negative trading bias until the stop-loss is triggered.

We recommend that traders stick to short positions, which were initiated at MYR3,642 or the closing level of 2 Mar. To manage risks, a stop-loss is can be set at MYR3,770.

The nearest support level is maintained at 1 Mar’s closing price of MYR3,684, followed by 2 Mar’s low of MYR3,598. Towards the upside, the immediate resistance is now seen at MYR3,767, followed by the 1 March’s high of MYR3,819.

Source: RHB Securities Research - 8 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024