COMEX Gold - Selling Pressure Continues

rhboskres

Publish date: Tue, 09 Mar 2021, 08:41 AM

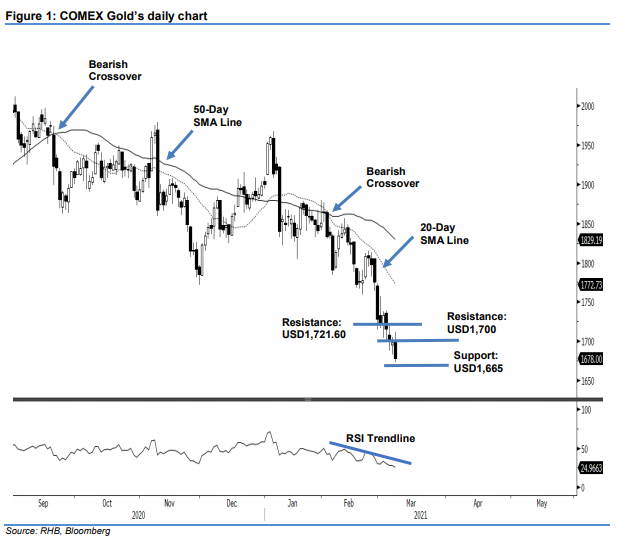

Maintain short positions. The COMEX Gold saw selling pressure intensify after falling below USD1,700. It plunged USD20.50 to settle at USD1678. On Monday, the commodity saw brief buying interest after opening higher at USD1,701.60, and climbed towards the session’s high of USD1,1712. Thereafter, the bulls shied away, and selling pressure persisted – pushing the commodity below the USD1,700 critical level, and towards the session’s USD1,673.30 low. Failure to regain the USD1,700 territory will see more selling pressure ahead. With the RSI pointing downwards, we expect negative momentum to test the lower support levels near USD1,665 and USD1,650. The commodity is drifting towards a 9-month low, with no sign of bottoming yet. As such, we maintain our negative trading bias.

We recommend traders stick to the short positions initiated at USD1,799, or the closing level of 16 Feb. For risk management purposes, the trailing-stop is revised to USD1,725.

The immediate support is revised to USD1,665, followed by USD1,650. Towards the upside, the resistance is pegged at the USD1,700 round figure, followed by 4 Mar’s high of USD1,721.60.

Source: RHB Securities Research - 9 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024