E-Mini Dow - Testing the 32,000-Pt Mark

rhboskres

Publish date: Tue, 09 Mar 2021, 08:43 AM

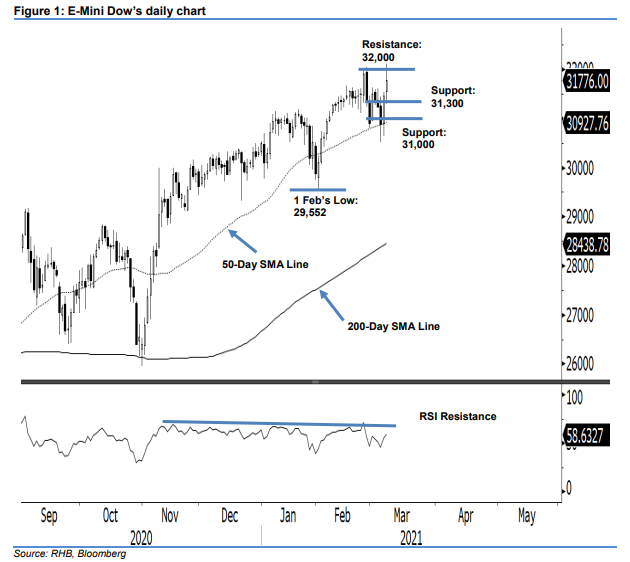

Maintain long positions. The E-Mini Dow continued its upward charge, following its recent completion of a relatively narrow A-B-C correction pattern, which saw the index retest the 50-day SMA line. Forming a second consecutive daily white candle, the index briefly crossed above the 32,000-pt level with 32,114 pts – a new record intraday high – before returning part of the gains to settle 311 pts stronger, at 31,776 pts. As a result, we now consider 25 Feb’s “Bearish Engulfing” formation as void, and that the index is now likely in the process of extending its multi-month upward move. This is supported by the rising RSI readings, which indicate momentum is picking up, and is yet to reach the overbought threshold. We maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, a stop-loss can be placed below 30,800 pts.

Support levels are revised to revised to 31,300 pts, followed by 31,000 pts. On the upside, the immediate resistance is eyed at 32,000 pts, followed by 32,300 pts.

Source: RHB Securities Research - 9 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024