WTI Crude - Negative Intraday Price Reversal

rhboskres

Publish date: Tue, 09 Mar 2021, 08:45 AM

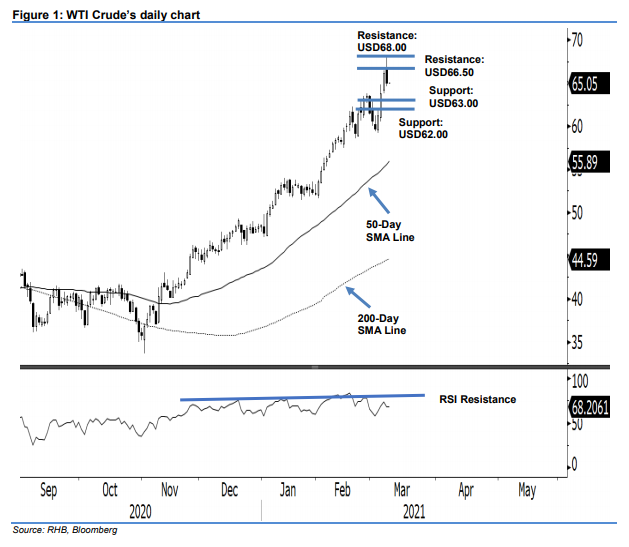

Pending confirmation of a correction; Maintain long positions. The WTI Crude briefly spiked to a high of USD67.98 during the early Asian trading hours. From there, it trended lower for the rest of the session, touching a low of USD64.57 before closing USD1.04 weaker at USD65.05. In our previous note, we highlighted that the commodity is trading in a possible maturing “Ending Diagonal” pattern, suggesting that its upward move may soon reach an apex – the latest negative performance is a warning signal of this. Should there be a negative through in the coming sessions – a downside breach of USD63.00 – it would signal that the commodity is entering a correction phase. For now, we keep our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below the USD63.00 threshold.

Support levels are maintained at USD63.00 and USD62.00. On the upside, the resistance levels are marked at USD66.50 and USD68.00 – slightly above the latest high.

Source: RHB Securities Research - 9 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024