FCPO - Approaching MYR4,000

rhboskres

Publish date: Tue, 09 Mar 2021, 09:04 AM

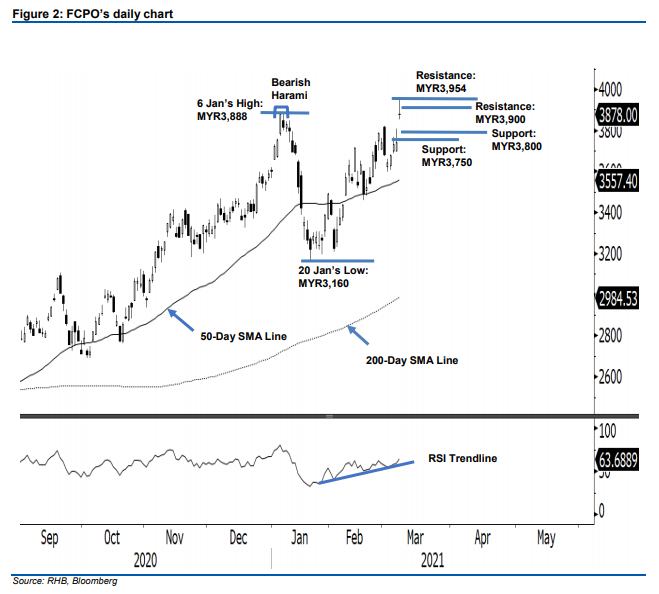

Stop loss triggered; initiate long positions. The FCPO trended higher for a fourth consecutive session, breaching MYR3,800 to close at MYR3,878. It gapped up MYR137.00 yesterday to open at MYR3,880 and surged to a session high of MYR3,954. The bulls were profit-taking during the final trading hour, which saw the commodity trimmed lower to close at MYR3,878 – recording a MYR137.00 gain from the previous session. From the price action, the FCPO has extended the upward movement by forming a “higher high” bullish pattern. Following a strong rally, we expect a minor pullback to retest the MYR3,800 level and consolidation between the MYR3,800 and MYR3,900 thresholds. Meanwhile, if the commodity manages to sustain and trade above MYR3,800, the bulls are eyeing to challenge the recent high of MYR3,954, as well as the MYR4,000 physcological level. Since the stop loss has been triggered and bullish momentum has picked up, we shift over to a positive trading bias.

Our previous short positions were closed out during the latest session after the stop loss was triggered. Conversely, we initiated long positions at the closing price of 8 Mar. To manage risks, a stop loss can be set at MYR3,750.

The nearest support level is revised to the MYR3,800 whole number, followed by MYR3,750. Towards the upside, the immediate resistance is now pegged at MYR3,900 and followed by 8 Mar’s high of MYR3,954.

Source: RHB Securities Research - 9 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024