WTI Crude - USD63.00 Support Holding Up

rhboskres

Publish date: Wed, 10 Mar 2021, 05:42 PM

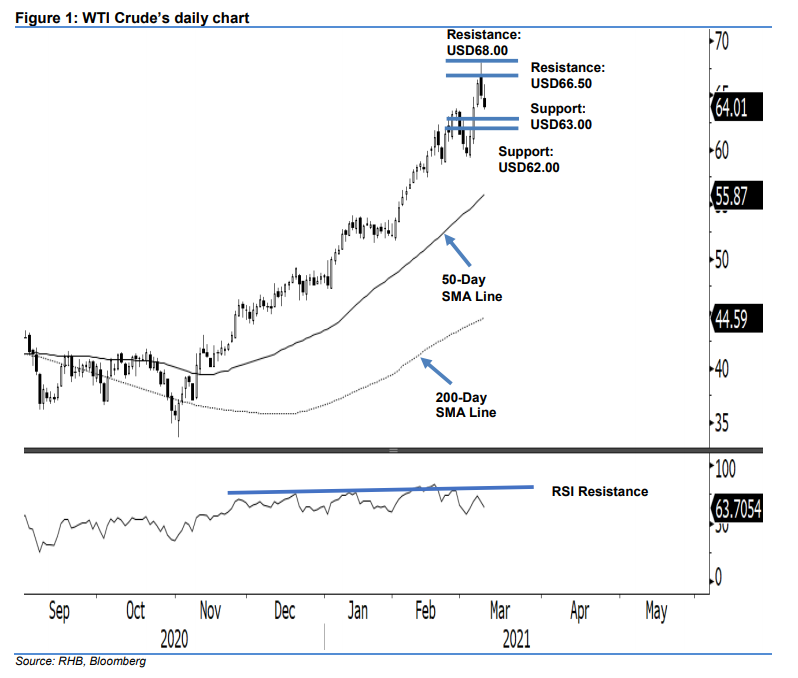

Maintain long positions. The WTI Crude’s attempt to rebound during its latest session was unsuccessful. After reaching a high of USD65.98 during the European trading hours, the commodity met waves of selling pressure, which sent prices consistently lower for the remainder of the session – it closed USD1.04 lower at USD64.01. While this was a negative follow-through from the previous session’s negative intraday price reversal, we keep to the view that the WTI Crude has to close below the USD63.00 support mark to signal the end to the possible “Ending Diagonal” pattern for us to consider the possibility for a deeper correction setting in. Hence, we maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop loss can now be placed below the USD63.00 threshold.

Support levels are maintained at USD63.00 and USD62.00. On the upside, resistance levels are marked at USD66.50 and USD68.00.

Source: RHB Securities Research - 10 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024