FKLI - Extending Higher

rhboskres

Publish date: Thu, 11 Mar 2021, 06:14 PM

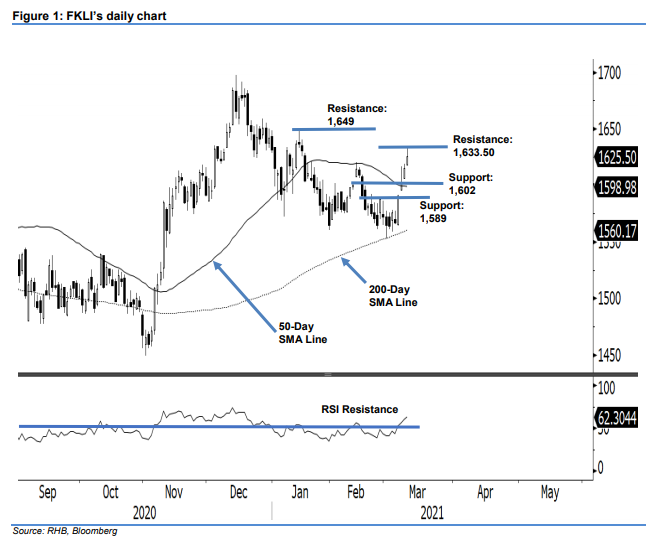

Maintain long positions. The FKLI posted gains for a fourth consecutive session, adding 10 pts to settle at 1,625.50 pts. Following a strong rally, the index gapped up to open at 1,618 pts. Riding on strong buying pressure, it surged to the day high at 1,633.50 pts before mild profit-taking in the afternoon trimmed gains to close at 1,625.50 pts. After breaching February’s high of 1,620 pts, the bulls are looking challenge January’s high of 1,649 pts. The RSI indicator has surpassed the 50% threshold, suggesting the bullish momentum is heating up and that the FKLI is on track to move higher. Meanwhile, we do expect a minor pullback in the coming sessions to retest the 50-day SMA line or downside support near the 1,602-pt level. As long as the stop loss stays intact, we maintain our positive trading bias.

We recommend traders maintain long positions, which were initiated at 1,591 pts, or the closing level of 5 Mar. To manage risks, the stop-loss level is adjusted higher to 1,580 pts.

The support levels are marked at 1,602 pts, followed by 25 Feb’s 1,589-pt high. Towards the upside, the resistance levels are pegged at 10 Mar’s high of 1,633.50 pts and 14 Jan’s 1,649-pt high.

Source: RHB Securities Research - 11 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024