Hang Seng Index Futures - Bullish Momentum Emerges

rhboskres

Publish date: Fri, 12 Mar 2021, 05:46 PM

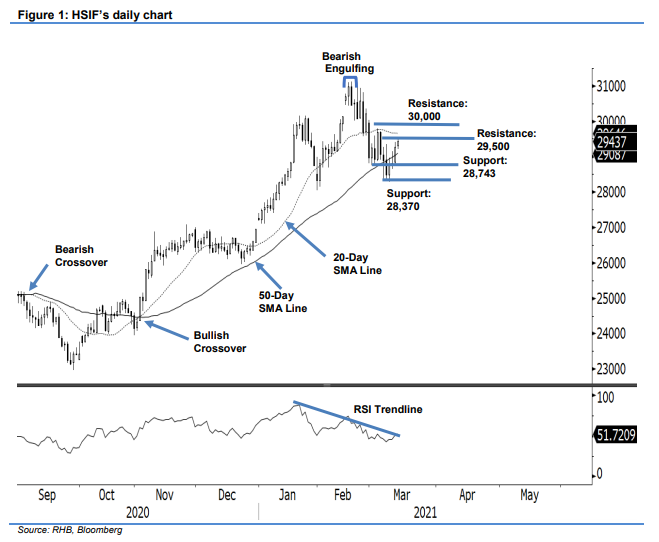

Maintain short positions. The HSIF saw bullish momentum building up yesterday, adding 472 pts to settle at 29,276 pts. It started the session stronger at 28,833 pts. After touching the day’s low of 28,781 pts, the bulls marched on, lifting the index towards the day’s high of 29,405 pts, before closing at 29,276 pts. Bullish sentiment was seen in the evening session, with the index closing higher at 29,437 pts after testing a high of 29,502 pts. As the RSI indicator is curving upwards, in tandem with index, it is very likely bullish momentum will follow though in the coming sessions, to test the 29,500-pt upside resistance. If crosses above the 20-day SMA line, momentum will continue towards the 30,000-pt psychological level. In the event the index falls below the 50-day SMA line, we may see the resumption of downward movement. We keep our negative trading bias until the stop-loss is triggered.

We recommend traders maintain the short positions initiated at 30,077 pts, or the closing level of 22 Feb. For risk management purposes, the trailing-stop is revised to 29,450 pts.

The immediate support revised to 1 Mar’s low of 28,743 pts, followed by 28,370 pts. Towards the upside, the immediate resistance is eyed at 29,500 pts, followed by the 30,000-pt psychological level.

Source: RHB Securities Research - 12 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024