WTI Crude - Moving Up the Trailling-Stop

rhboskres

Publish date: Fri, 12 Mar 2021, 05:49 PM

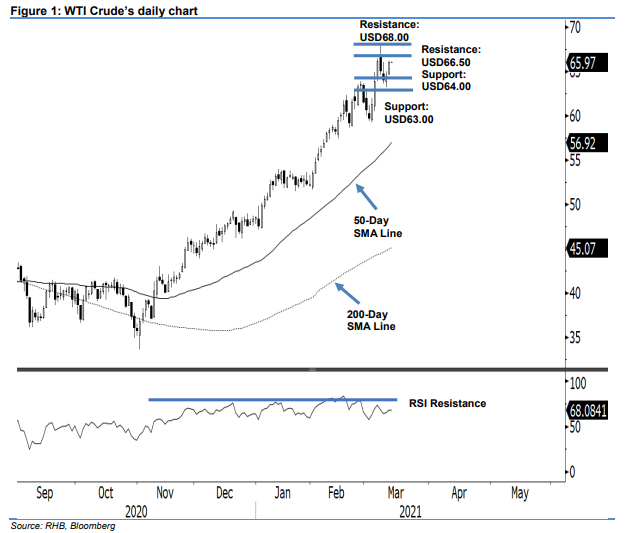

Maintain long positions, as buyers have re-emerged. After experiencing a bout of volatility during the European and early US trading hours, the WTI Crude ended the latest session USD1.58 higher at USD66.02. The low and high were posted at USD64.54 and USD66.21. The intraday struggle, and the positive end suggest that the bulls are still in the driver’s seat. The commodity has been rebounding from around USD63.00 over the last two sessions, and we are now believe the rebound is likely to extend in the short term, provided the USD64.00 threshold does not fail. The only yellow flag that we note, is the still-high RSI reading, which could limit the potential upside movement.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below the USD64.00 threshold.

Support levels are revised to USD64.00, followed by USD63.00. On the upside, resistance levels are set at USD66.50 and USD68.00.

Source: RHB Securities Research - 12 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024