COMEX Gold - Hitting a Wall

rhboskres

Publish date: Fri, 12 Mar 2021, 05:50 PM

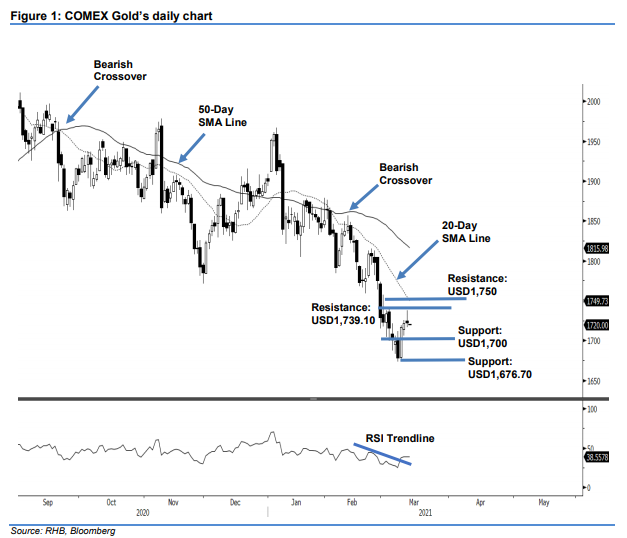

Maintain short positions. Despite running into a wall of resistance, the COMEX Gold added USD0.80 to settle at USD1,722.60. Yesterday, the session started higher at USD1,725. During the first half, buying pressure lifted the commodity to a high of USD1,738. However, moving into the US pre-market trading hour, selling pressure emerged near the resistance level, dragging it to a low of USD1,716.80, before closing at USD1,722.60 – forming a Shooting Star pattern, which indicates that the bulls were overwhelmed by the bears. As such, the negative momentum may follow through, and correct towards the USD1,700 region. If the bulls manage to consolidate and breach the upside resistance, the counter-trend rebound may rise towards USD1,750 or near the 20-day SMA line. As the trailing stop remains intact, we maintain our negative trading bias.

We recommend traders stick to the short positions initiated at USD1,799, or the closing level of 16 Feb. For risk management purposes, the trailing-stop is set at USD1,725.

The immediate support is unchanged at USD1,700, followed by 9 Mar’s low of USD1,676.70. Towards the upside, the resistance is seen at 3 Mar’s high of USD1,739.10, followed by the USD1,750 round figure.

Source: RHB Securities Research - 12 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024