WTI Crude - Minor Pause

rhboskres

Publish date: Mon, 15 Mar 2021, 08:57 AM

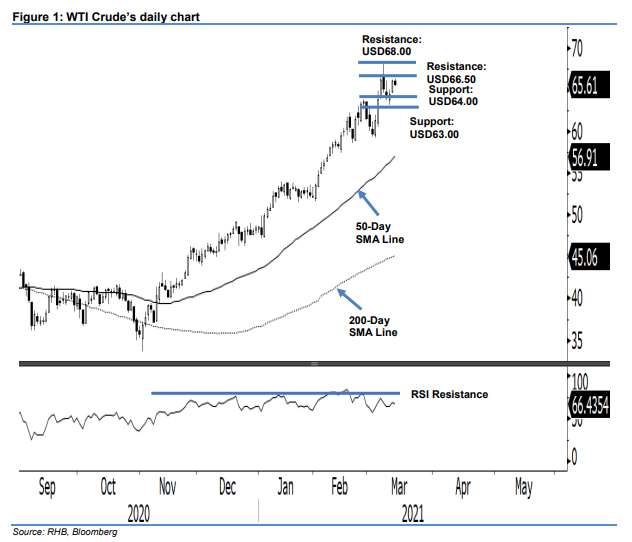

Maintain long positions. Last Friday session’s intraday price movements suggest that the WTI Crude is taking a breather after the previous two sessions’ rebound off from a price area near the USD63.00 mark. For the session, the commodity essentially traded sideways in the range of USD65.41-66.24, before closing USD0.41 lower at USD65.61. We are keeping our bias that the commodity’s uptrend is still intact despite the recent weeks’ sharp gains that have triggered profit taking over the past few sessions. Towards the downside, the risk for a deeper and lengthier correction phase to set in would be confirmed if the USD64.00 support fails to hold. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, the stop-loss can now be placed below the USD64.00 threshold.

The support levels are maintained at USD64.00, followed by USD63.00. Moving up, the resistance levels are set at USD66.50 and USD68.00.

Source: RHB Securities Research - 15 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024